Baidu Purchased $306 Million Majority Stake In Qunar In 2011#

With China’s burgeoning luxury e-commerce market expected to have surpassed US$3 billion this year, fashion retailers like Net-A-Porter, YOOX, and Neiman Marcus, designers like Alexander Wang and brands like J. Crew and Coach aren’t the only companies hoping to tap China’s wealthier online big spender. As more Chinese outbound tourists hit the world stage, over the past year high-end travel has emerged as another online battleground. No longer driven by a singleminded focus on spending the majority of their time overseas on shopping, a steadily increasing number of wealthy Chinese tourists -- often on their fifth or sixth international jaunt -- are spending more on accommodations and experiential travel, a development on which a handful of niche travel e-commerce sites have been quick to pounce.

Most recently, a new subsite launched by Baidu-owned Qunar joined this nascent e-commerce segment, joining Ctrip-owned Trip TM, high-end Zanadu, and Africa-focused

Quafrica#

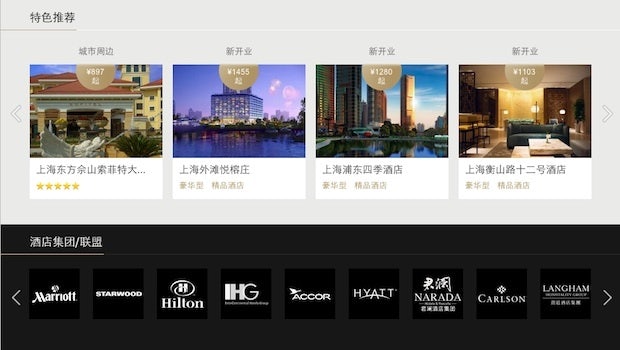

in chasing China's more seasoned globetrotter. According to Tech in Asia, the new segment (lh.qunar.com) offers rooms at over 2,000 luxury hotels in top Chinese cities and tourist destinations, employing a more minimalist aesthetic than its mass-market counterpart.

While it's not exactly groundbreaking, Tech in Asia notes that Qunar's new luxury section is a smart move as Chinese travelers go further upmarket:

[The new section] contains nothing that Qunar didn’t already offer on its site for years, but now its top hotels have been compartmentalized and presented on a much nicer page. So it’s a pretty minor roll-out, but a smart move to make, allowing Qunar to better showcase its hotel chain partners, such as Hyatt and Shangri-La, and the numerous boutique and designer hotels that are available. For now the new luxury hotel portal is focusing on just 10 cities.

According to Qunar, the decision to set its higher-end offerings apart from mass properties was something of a no-brainer, as a little over one-fifth of the site's bookings are for rooms costing over 500 yuan (US$80) per night. As Tech in Asia adds, Qunar is boasting that its site is able to offer 10 percent lower prices than rival Ctrip on more than 60 percent of its five-star offerings.

As Jing Daily noted last year, the ongoing “niche-ification” of China’s e-commerce market — whether it be startups focused on bespoke fashion, accessories, health or tourism — is an important development to watch. Progressing from the early “big-box” platforms like Taobao to specialized sites doing one thing efficiently, niche sites may find themselves in a better position as the crowded luxury e-commerce market in China sees a continuing industry shakeout.