Editor’s note#

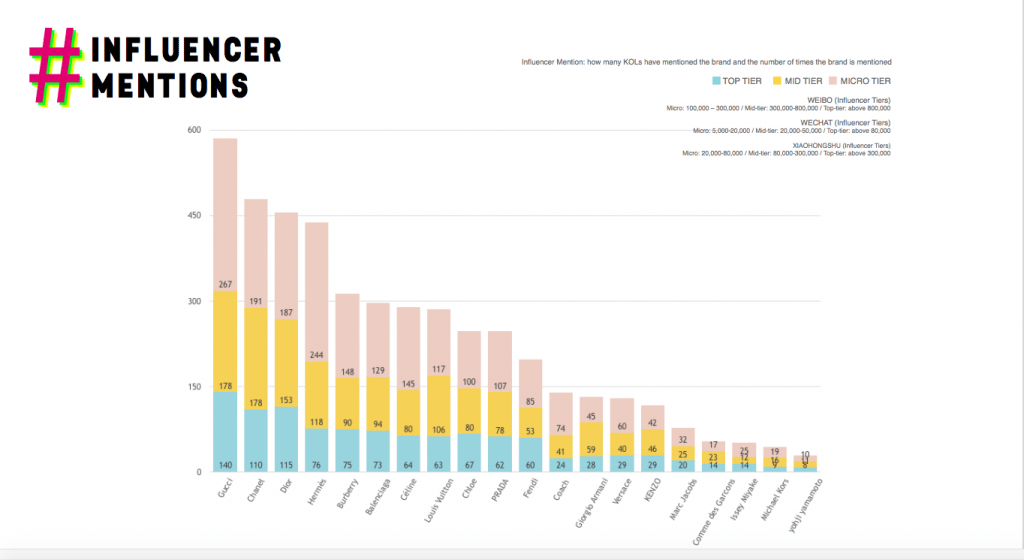

: A new luxury industry report from influencer marketing agency PARKLU reveals that Gucci, Chanel, and Dior are leading the way when it comes to generating awareness and engagement on Chinese social media channels.

The report analyzed social media influencers’ awareness and engagement data for 20 top luxury brands from France, Italy, Japan, Britain, and the United States. PARKLU’s report data is sourced from 19,000 top, mid, and micro-tier influencers across 11 Chinese social media platforms. Additionally, WeChat and Baidu’s Index results were used to provide a broader awareness reference.

Elijah Whaley, the CMO of PARKLU, provided Jing Daily with a rundown of the report.

Across most metrics, Gucci, Chanel, and Dior outperformed all other brands. In addition to paid campaigns, they received the most organic mentions by Chinese luxury influencers.

Gucci#

Gucci joined China’s social media game relatively late but now sets social media aesthetic standards. Gucci has also been able to connect with China’s youth in a way no other luxury brand has been able to attain. By and large, Gucci seems to understand better than most luxury brands that social media is not a marketing tool but an extension of its brand. They have created opportunities for conversations to form around the brand by pushing the boundaries of modern youth-focused luxury fashion. Gucci also seems to design its fashion for social sharing. What’s most interesting is that Gucci’s dominant performance is a global phenomenon. The brand is doing things right and other luxury brands would be wise to take note.

Chanel#

Though not entirely responsible, a large reason for Chanel's exceptional engagement rates in March was the brand’s reversal of their long-standing policy to not pay social media influencers.

Before March 2018, Chanel had a strict non-paid product seeding influencer marketing policy. Though non-paid product seeding can have wonderful benefits for brands that practice it properly, there are several downsides to this tactic. In most cases, brands that practice non-paid product seeding cannot dictate influencers’ posting schedules, post content, or posting mechanisms like rewarding fans with prizes for engagement. Since Chanel has shifted their policy to pay influencers for posting, they now dictate execution strategy, which has unsurprisingly lead to much high engagement rates.

Dior#

Despite the controversy, Dior has often been ranked highly among Chinese consumers. In late March, Dior held their first ever China-based haute couture fashion show in Shanghai. The show was part of a greater attempt by Dior to put on a younger, trendier face in the China market. In addition to inviting numerous fashion KOLs to attend the show, Dior live-streamed the event and invited influencers from trendy video app Douyin to attend the after-party.

Focusing on SEO versus Social Media#

Gucci’s dominance was affirmed by Baidu and WeChat indexes. Coach, Burberry, Chanel, and Dior also performed relatively well on Baidu’s index. However, it’s obvious that some brands like Burberry focus more attention on search optimization than social media awareness, while brands like Coach, Chanel, and Dior take a more balanced approach.

Either way, it is clear that China’s social media influencers are digital trendsetters as deeper data analysis showed that Baidu and WeChat Indexes lag or directly correlate to influencers’ social media activity.

Social Media Not an Option for Luxury Brands in China#

Over the past decade, social media has become tremendously influential to China’s luxury fashion industry. Currently, 82 percent of luxury consumers consider themselves heavy social media users. The main platforms influencing luxury customers today are WeChat, Weibo, Xiaohongshu (RED), and Douyin. Many of China’s luxury tastemakers are social media bloggers who wield a great deal of influence on these four platforms.

The importance of luxury brands' promotion by influencers should not be underestimated. As traditional mass media outlets have lost popularity with China’s youth, divergent luxury-focused social media influencers have risen to fill the information and entertainment void. Luxury influencers' impact extends far beyond social media as their comments on trends, styles, and brands more broadly impact social indexes, search engine indexes, and e-commerce platforms' search and sales. And, the larger the influencer, the great the impact, as a culminating ripple effect takes place when smaller influencers follow their lead.

Click HERE for the full report.