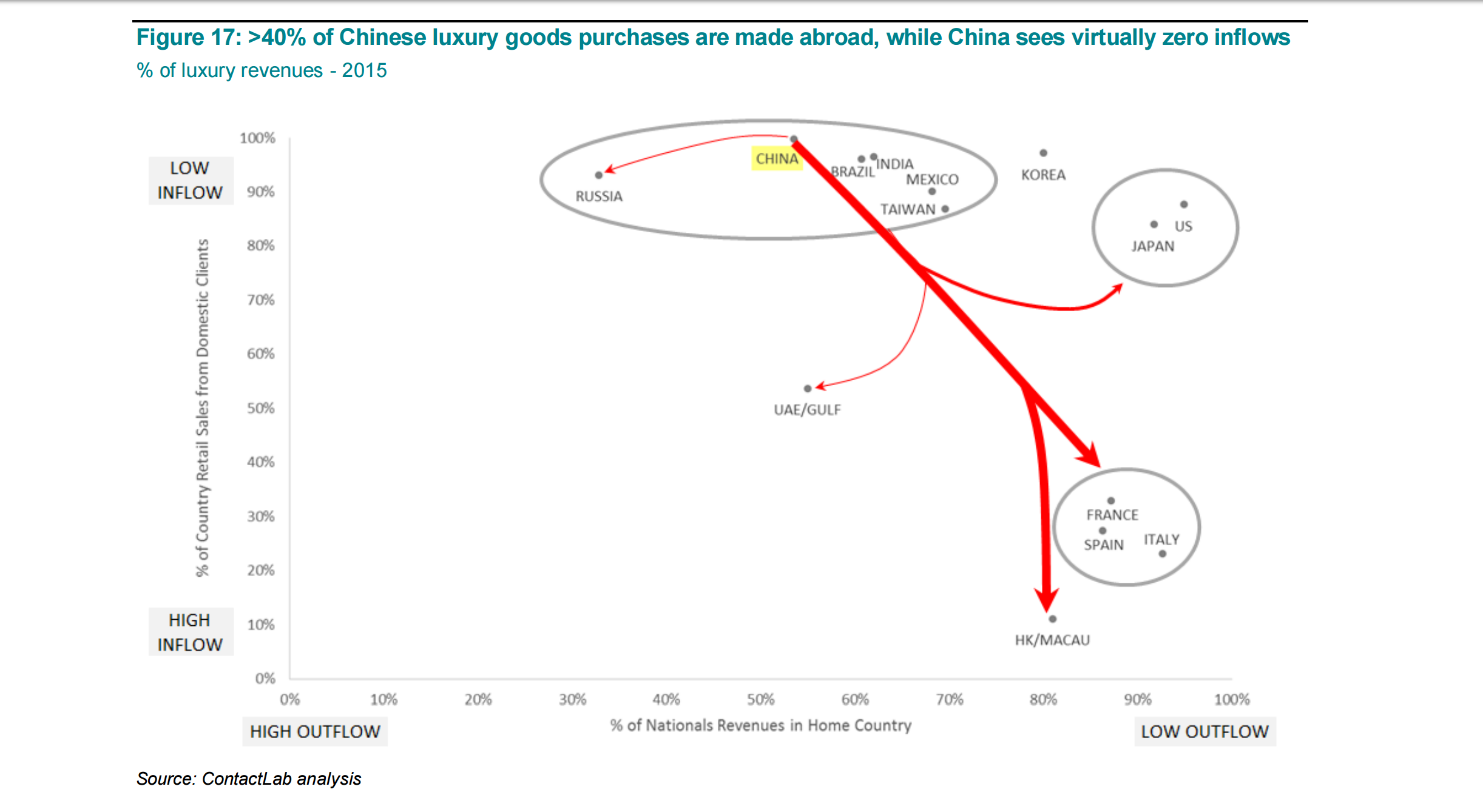

Chinese travelers are spending billions of dollars abroad, but where exactly are they making their luxury goods purchases? A recent report titled “Who Buys Where: Decrypting Cross-Border Luxury Demand Flows” by digital direct marketing services provider ContactLab and Exane BNP Paribas Research maps out spending patterns by tourists from all over the globe based on three years of data. ContactLab's research ranks Chinese travelers second in terms of the proportion of spenders who buy luxury goods abroad, finding that 40 percent of Chinese consumers' luxury spending occurred overseas in the first part of this year.

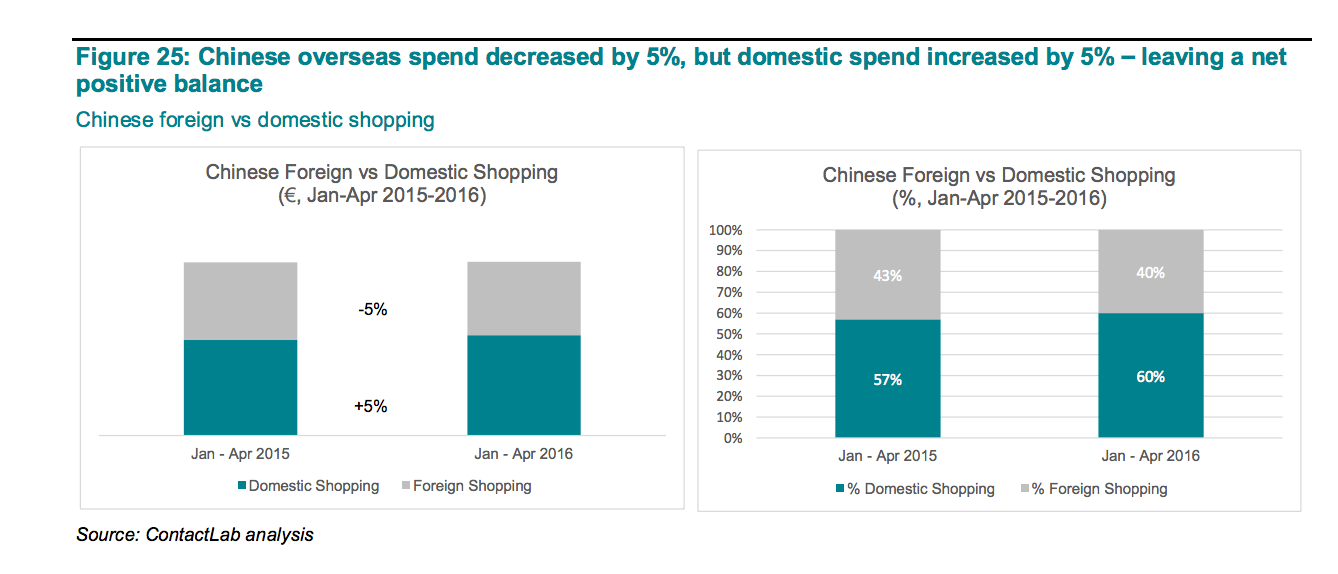

While Chinese consumers spend most of their budget on luxury items abroad, this year, overseas spending dropped 5 percent, but rose 5 percent domestically. ContactLab attributes this to price corrections by major luxury brands on the mainland. For example, last year, Chanel lowered its mainland China prices to encourage Chinese shoppers to purchase there, and deter daigou sellers from benefiting from purchasing cheaper goods abroad.

How much Chinese spend abroad may provide some insight into exactly who these consumers are. The value of purchases Chinese travelers make in “European Heritage” countries, the United States, and Japan is significantly lower than it is in China—by 20 to 30 percent. ContactLab says this suggests big spenders in these countries are “aspirational first-time buyers.”

However, despite individual purchases being lower overall, Chinese luxury spending in Europe “appeared to be rising” in the first four months of 2016 compared to the same period two years before, according to the report. This was the case even factoring in the Paris terrorist attacks in late 2015. The increase takes place “possibly because our data includes also a portion of daigou spend (eg Chinese students in Europe whose visas don’t allow tax free refunds, and which are therefore not captured by Global Blue statistics),” said ContactLab senior advisor Marco Pozzi. “If this is what we see in the wake of the November terrorist attacks, then 2H16 could reasonably expected to be even more positive.” It's still worth noting that since the release of the report last month, there have been further attacks in Europe and numerous luxury brands have reported that they are feeling the repercussions of waning Chinese tourists in light of security concerns.

In Asia, Chinese tourist luxury spending has also gone up in the last few years in Japan and Korea. In Japan's case, Chinese travelers make up the majority of the luxury purchases, even though inbound tourists only make up about 5 to 15 percent of sales in the country overall.

The report also confirms known trends in Hong Kong and Macau's luxury retail industry. This year, Chinese consumers have done almost the same amount of luxury shopping in Japan, Taiwan, Singapore, and Korea combined as they have done in Hong Kong and Macau. Chinese tourists went from spending 70 percent of their luxury goods budget in Hong Kong in the first four months of 2014 to spending 35 percent in the same period this year. Hong Kong's luxury retail industry has been struggling with the absence of Chinese tourists and developers are being forced to find alternatives to high-end stores to attract shoppers. This month was the first in over a year where Hong Kong finally experienced a rebound in tourists from the mainland.