Blue-Chip Chinese Artists, Historical Works Continue To Draw Collectors, With 92 Percent Sold By Value#

Contemporary Asian Art auction at Sotheby's Hong Kong (Image: Sotheby's Hong Kong)

Following the successful run of the second and final portion of the Ullens collection of Chinese contemporary art at Sotheby's in Hong Kong this past weekend, the British auction giant's Contemporary Asian Art auction on October 3 again saw energetic bidding by Chinese and other Asian collectors, finally achieving total sales of HK$227 million (US$29 million). Despite disappointing bidding for works by Japanese and Korean artists, Chinese buying pushed this auction to the highest total for a various-owner sale in this category for Sotheby's Hong Kong. Driven primarily by Chinese demand for blue-chip works by top Chinese artists, the sale bested pre-sale estimates by HK$28 million (US$4 million).

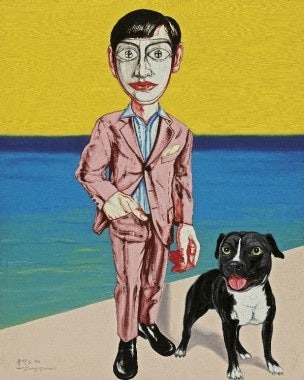

As expected, increasingly savvy Chinese buyers homed in on top-quality works by blue-chip Chinese artists. The top lot of the sale -- Zhang Xiaogang’s "Bloodline: Big Family No.1" -- beat high estimates, going for HK$65.6 million (US$8.4 million), reaching the second-highest price for the artist at auction and achieving a record for Zhang's trademark "Bloodline Series." This puts "Big Family No. 1" right behind Zhang's earlier work "Forever Lasting Love" (1998), which sold for a record-breaking HK$79 million (US$10.1 million) at Sotheby's Hong Kong this spring, more than double its high estimate.

Chinese collectors continue to be enchanted with Zeng Fanzhi

As global stock markets tumbled on an darkening world economic outlook, Reuters opined that more tempered overall bidding at today's auction indicated that “cracks [are appearing] in Asian demand for contemporary art,” adding that “mid-tier works struggled to find buyers, with 27 percent of Asian contemporary works and 22.6 percent of the 20th century Chinese art work failing to sell on tepid bidding.” However, a quick glance at the breakdown of works sold in the auction shows a significant progression in the buying habits of Hong Kong and mainland Chinese buyers. With unexpectedly low interest among bidders for the contemporary Japanese and Korean works up for auction, Chinese lots had to hold up the entire sale. Taking that into consideration, and breaking Chinese lots up between top-quality pieces and those by lesser-known artists, blue-chip Chinese artists -- those preferred and actively sought after by new Chinese collectors -- were 92 percent sold by value. This hardly indicates any cracks in demand among wealthy Chinese collectors.

As Bloomberg wrote today, amid turbulence in the Hang Seng and signs that China’s economic growth is set to slow, bidders in Hong Kong maintained strong confidence in names like Zhang Xiaogang and Zeng Fanzhi. In addition to Zhang's record-setting "Bloodline: Big Family No.1," rare and historic works by Zeng Fanzhi accounted for five of the top ten sales, with his “Mask Series 1998 No.5” selling for for HK$30.9 million (US$3.96 million), “Mask Series” selling for HK$10.74 million (US$1.38 million), “Untitled-Landscape” selling for HK$7.82 million (US$1 million), “Red Road” selling for HK$7.82 million (US$1 million), and “Portrait 08-4-1” selling for HK$5.42 million (US$695,386). One day before, at Sotheby’s Ullens sale in Hong Kong, Zeng's 1998 oil on canvas, “Mask Series 1998 No.26″ led the pack, achieving HK$20.26 million (US$2.6 million). If mainland Chinese collectors are becoming more discriminating and at times overlooking mid-range artists, it's obviously not having an effect on blue-chips like Zeng Fanzhi.

Following the Contemporary Asian Art auction, Lin Jiaru, head of Sotheby’s Asian art, said that this auction set a new record in terms of total turnover, indicating that top names like Zhang Xiaogang, Zeng Fangzhi, and Liu Ye remain highly sought after by Chinese collectors. Echoing Lin's sentiment, Taiwanese collector Jeffery Yu said, “Chinese property isn’t doing well, nor are stocks so they’re still putting money into the best [Chinese] art.”

With the Chinese property market remaining fragile and restricted, and the global financial market tumultuous, this week's auctions in Hong Kong indicate that Chinese collectors remain first and foremost pragmatic. Rather than looking to build their collections with young and emerging artists, or Western, Japanese or Korean artists, these collectors, in the words of gallery owner Pascal de Sarthe, "have financial power and are buying their own artists first." Only they're not doing it out of patriotism (or at least not solely), they're doing it pragmatically.