Cartier's Ballon Bleu was listed as one of the most-searched Swiss watch models in China in a new Digital Luxury Group report. (Cartier)

Luxury Swiss watch sales may have taken a major hit from China’s anti-corruption crackdown, but Chinese consumers are searching for them online more than ever—especially on their phones.

That's the finding of a new report released today by consultancy Digital Luxury Group, which tracked internet searches for 62 watch brands across 20 different markets, including China.

China’s ongoing anti-corruption crackdown caused Swiss watch exports to China to decline by 12.5 percent in 2013. However, the firm's World Watch Report finds that Chinese consumers certainly didn't lose interest in the luxury timepieces, if you take their internet search habits into account.

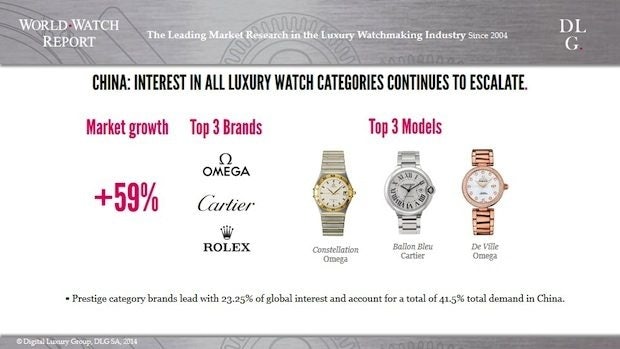

According to Digital Luxury Group, China saw the highest growth in overall Swiss watch searches globally, with an increase of 59.4 percent. In addition, mobile searches for haute horlogerie Swiss watch brands grew by a staggering 120 percent in 2013, demonstrating the importance of the platform to the luxury watch market.

Omega, Cartier, and Rolex were the leading brands in Chinese internet searches, according to the report. With data provided by search engine giant Baidu, the report finds that “the Chinese luxury market is not dead” when it comes to watches.

“Watches are part of the fastest growing luxury segments in China right now,” said Baidu Vice President Liang Zeng. Favorite models in China included the Constellation and De Ville by Omega, and Ballon Bleu by Cartier.

The growth in China’s watch searches can be attributed mainly to those for women’s watches, which surged 145.5 percent. When it comes to women’s watches specifically, Omega, Vacheron Constantin, and Chopard saw the highest gains in searches, while Rolex led the pack with 26.5 percent of all interest.

Meanwhile, top haute horlogerie brands on Chinese mobile searches were Patek Phillippe, Vacheron Constantin, and Jaeger LeCoultre.

Guangdong, Jiangsu, and Zhejiang provinces were the top three locations for watch searches, with 11.9 percent, 8.4 percent, and 8 percent of all China searches, respectively. These provinces were followed by Beijing and Shanghai, which were almost tied at 7.6 percent and 7.4 percent. However, Shanghai dominated when it came to density of searches by area, followed by Beijing.

In order to see how many of these searches could actually lead to sales, the report also tracked words associated with the search and what types of pages consumers clicked once the search was conducted. The top “search intention” category was brand, which took up 80.1 percent of all searches, followed by price, which comprised only 7 percent. These searches are creating some serious customers, however—20.7 percent of searchers ended up on an e-commerce page. Meanwhile, 19.8 percent just seemed to want information about the watches, ending up on the Wikipedia-like Baidu Knowledge.

Swiss watch companies can benefit from paying close attention to Chinese search-engine optimization (SEO), since China's role in online watch searches is huge—Chinese consumers make 23.25 percent of all global Swiss watch online searches.