Bringing in US$14.3 billion in sales last year, Alibaba’s e-tail holiday Singles’ Day dwarfs other international shopping days such as Black Friday in the United States, which made US$10.4 billion in 2015. But the Chinese e-commerce event is no longer confined to just Alibaba—or China, for that matter—as it rapidly expands abroad and attracts luxury retailers.

A growing number of U.S.-based retailers are embracing Singles’ Day after testing the waters over the past few years. One of the earliest U.S.-based adopters is Dealmoon, a shopping deals site focused mainly Chinese-American audience, which has participated in Singles’ Day for four years in a row. Luxury features heavily into the site’s promotions, as it has partnered with Neiman Marcus, Bergdorf Goodman, Nordstrom, La Mer, and Kate Spade for the holiday in the past. This year, it’s partnering with around 250 different merchants.

Dealmoon Co-Founder and CMO Jennifer Wang says that American retailers’ interest in the shopping event has grown significantly. “[In] the first year, only 20 merchants responded, and the second year it was 200, then the third year—last year—we had over 180 merchants that signed up for Singles’ Day,” she says.

Despite its focus on dirt-cheap discounts on every item one could think of in China, Singles’ Day is being billed by some e-tailers as a more upscale alternative to the mass shopping event Black Friday in the United States. “Because most of our users buy luxury products,” says Wang, “we are growing this event to be more and more like Black Friday for luxury products.” She believes that the discount holiday caters to a demand that hasn't been met by Black Friday, which is focused more on items like appliances or electronics.

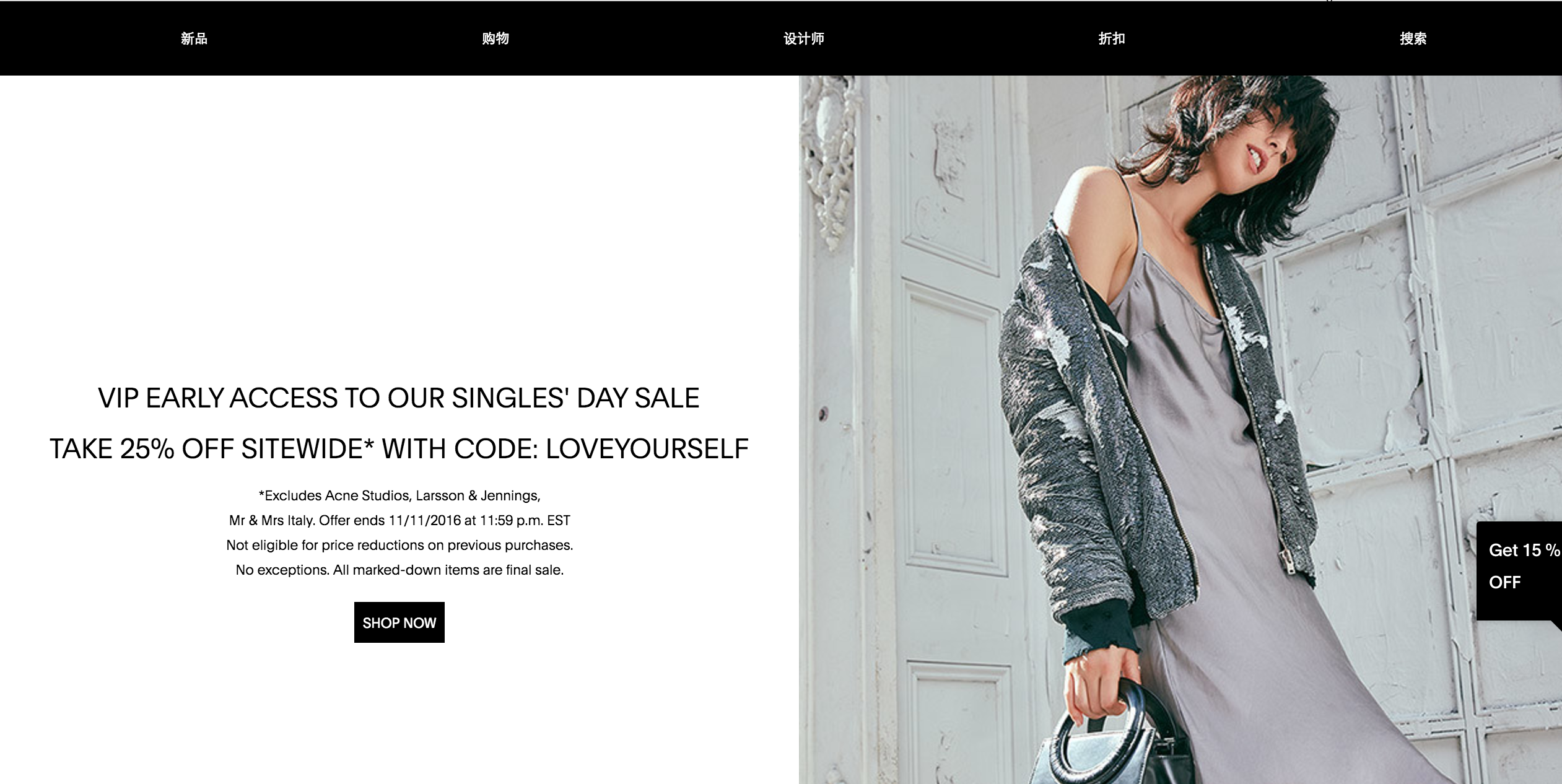

In addition to luxury department store giants, small niche luxury retailers with an eye toward the China market are also getting in on the trend. New York-based multi-brand fashion boutique Otte, which stocks a curation of young, hip labels such as 3.1 Phillip Lim, Acne Studios, and Alexander Wang, is offering a Singles’ Day sitewide 25 percent off promotion, which it hopes will appeal to both American customers and Chinese consumers ordering through its online shop via its Chinese site. The retailer is taking part in the holiday for the third year in a row, and its second year outside China.

This international push is becoming much more pronounced this year, says Nancy Zhang, the vice president and COO of Otte. “I really believe that globally brands are going to be on it this year,” she says of Singles’ Day, “and if they have not made it this year, they are really going to miss the boat.”

International retailers such as Dealmoon and Otte are leveraging their Chinese-language social media accounts on Weibo (Dealmoon has 110 million followers) and WeChat to promote the deals in China and to Chinese-speaking customers in the United States, while additional promotions are aimed at spreading the event across America. “On the U.S. side, it is going to be explaining and winning over our U.S. customers on getting excited for Singles’ Day,” says Zhang. “A lot of people know what it is, but they might not know what it is about.”

For luxury retailers shipping into China from abroad, China’s recent tariff hikes on cross-border goods over 2,000 RMB have loomed large over business. According to Zhang, Otte’s cross-border sales to China took a hit from the new tariffs, but customers have found ways around them. “It certainly affects us; it has not completely killed us,” she says, noting that the business can still benefit from sales to daigou sellers. She also notes that a contingent of the brand’s Chinese luxury online shoppers are more focused on product than price and “are used to be paying tariffs” to get hard-to-find items and coveted niche labels.

Wang agrees that international shipments to China can be tricky, stating, “I think it is definitely a harder process to have somebody learning how to order from our site.” But both she and Zhang agree that steep Singles' Day discounts are good for incentivizing purchases in China in spite of the tariffs.

Singles’ Day promotions in the United States do have their fair share of mass-market deals, however—especially when it comes to Chinese e-commerce sites selling to Americans. Payment giant PayPal is promoting Singles’ Day to American consumers through partnerships with several Chinese websites offering dirt-cheap prices on goods shipped to U.S. consumers. “China is one of the most popular destinations for PayPal’s U.S. consumers to shop internationally,” says PayPal Head of Global Initiatives Anuj Nayar, who notes that “U.S. consumers are increasingly taking advantage of deals beyond the traditional holidays and their own backyards.”

While many luxury brands worry that participating in a discount holiday could make their image seem too mass-market, beauty brands and affordable luxury labels have been more eager to participate. According to Zhang, this is a “widespread, general concern,” in the retail industry, but she believes brands will need to adapt to the influence of technology. “At this point, with the mobile adoption reach in China, mobile adoption reach globally, and the internet adoption reach globally, I think it is silly not to have any kind of e-commerce,” she says. “You have to be in e-commerce.” For brands that are still on the fence, she believes that “the popularity of the Singles’ Day just goes to show how much demand there is out there for shopping-related, discount-related events.”