Already Numbering Over 100 Million, The Chinese Middle Class Is Powering China's Luxury Market#

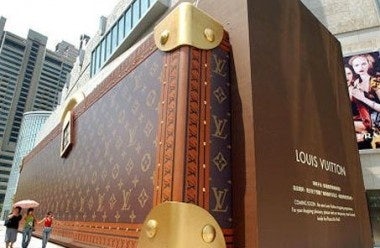

China's luxury market has gained a lot of attention this year, mainly because it remains one of the few global markets where more luxury retailers are entering the market, rather than cutting back or leaving it altogether (as we've seen by more than one luxury retailer in Japan this year). Although a good deal of luxury spending in China comes from the country's small percentage of free-spending ultra-rich (who now number 143,000 RMB multimillionaires and 8,800 RMB billionaires in Beijing alone), as we've discussed before, many of China's ultra-rich prefer to do their luxury shopping overseas -- where Mainland China's notorious luxury tax can't bite them.

For China's still-new but growing middle class, foreign travel, or trips over the border to Hong Kong, remain a luxury that most can't fit into their schedules or afford. It's this group that luxury marketers are increasingly identifying as the future of the Chinese luxury market. They're not rich, but they're willing to spend what they make on luxury goods.

From Investment U:

Emerging Asia’s role in the market for high-end luxury goods is mushrooming – and isn’t expected to slow down any time soon.

General household spending within Asian developed nations should continue to increase, as economic growth, rising populations and improving health/retirement provisions reduce the need for families to save for the proverbial rainy day.

Naturally, these trends show most strongly in China – already the world’s third-largest luxury market and a country that already has a big crush high-end brands. As salaries continue to grow among both the wealthy and growing middle class, that crush should turn into a full-blown love affair.

Already, Shanghai’s female office workers already have a reputation for spending a hefty chunk of their month’s salary on a handbag or a pair of shoes. And New York-based market research firm, Pao Principle, found that almost 90% of well-heeled Chinese surveyed had purchased a designer handbag over the past year.

An important point here is the youthful nature of the Chinese middle class luxury shopper. In terms of demographics, the target market is a female, in her mid-twenties, college-educated, and in first- and second-tier cities.

While the number of young people in China who can afford top luxury goods is formidable, it is admittedly only a segment of a segment of this age group, as it is in most global markets. However, what makes them remarkable in China is the speed at which they have not only found and stuck with the brands they like, but have become immensely influential to marketers and designers around the world.

Ding Wenlei, writing for the Beijing Review, looks into the importance of the Chinese luxury market to global brands, who are looking to “glocalize” their products for emerging markets in China and India:

A recent report, The 2009 Report on China’s Luxury Goods, compiled by public relations agency Ruder Finn Inc. and Albatross Global Solutions, a marketing services agency for luxury brands in Asia, showed that while the financial crisis caused general decline in demand for luxury brands in Europe, America and Japan, the Chinese luxury goods market is still thriving, indicating the economic impact of the financial crisis on China is relatively limited.

The report said China surpassed the United States to be the world’s second largest luxury goods consumer after Japan, from the beginning of 2008 to January 2009, accounting for 25 percent of global sales. The Ministry of Commerce last September predicted China would become the world’s largest luxury market by 2014, accounting for 23 percent of global business.

Although Chinese domestic consumers became more sensitive to the prices of luxury goods due to the global economic downturn, they’re still confident of the future, according to the report.

The report said more than half of the about 1,000 respondents didn’t think the prices will affect their consumption behavior, and nearly 90 percent said that they would not change their preferences for luxury goods just because of the economic weakness.

China’s expanding middle class constitutes an important group of consumers who desire and can afford luxury goods. According to Understanding China’s Wealthy, a Mckinsey quarterly report released in July 2009, the number of well-off Chinese households, which have more than $36,500 in annual family income, stood at 1.6 million last year and will grow by 16 percent every year to reach 4.4 million by 2015, next to the United States, Japan and Britain.

The article goes on to spotlight the young generation of Chinese luxury shoppers, pointing out that children born in the 1980s were really the third generation to emerge as shoppers in the global sense of the word following China’s market reforms of the late 1970s:

China’s luxury shoppers are strikingly young, many of them self-employed or part of a growing professional class. Eighty percent of them are under 45, compared with 30 percent of luxury shoppers in the United States and 19 percent in Japan, according to the McKinsey report.

According to Tian Dapeng, a rock singer who has been a luxury consumer for years, three generations of wealth accumulation will help foster a true class of luxury consumer.

“The first generation that built up from nothing is not likely to consume luxury goods and the second generation who witnessed the hardships their parents encountered in building up wealth are sensitive to prices of luxury goods,” he said.

“Only the third generation who have grown up with a golden spoon and begun to know a number of luxury brands since their childhood, are less price-sensitive and display a high loyalty to certain brands.”