Gilt has teamed up with Alipay to serve Chinese customers.

This article was published earlier in our weekly newsletter. Sign up through our “Newsletter Sign Up” box on the right.

Once the world's fastest-growing e-commerce market, a new report released this week finds that China's e-tail industry has been surpassed by a surging United States. But even as it slides into second place, China's online shopping “borders” are becoming increasingly blurred as e-commerce giants forge increasingly global links.

Published this week, A.T. Kearney's biennial global e-commerce index measures the attractiveness of e-commerce markets by country, measuring the size of the market as well as the potential for growth and development of infrastructure. The report noted that China’s economic slowdown and lagging infrastructure were the main reasons behind its demotion.

However, the differentiation between “U.S.” and “Chinese" e-commerce is quickly fading away as a host of new innovations link China’s online shoppers with international markets. Just this week, Chinese e-commerce giant JD.com launched JDWorldwide, its new cross-border e-commerce platform, to compete with rival Alibaba’s Tmall Global. According to JD.com, the new site will allow online shops to ship to buyers in China from abroad through the site’s own in-house infrastructure. The site is also partnering with eBay to allow vendors to sell directly to China.

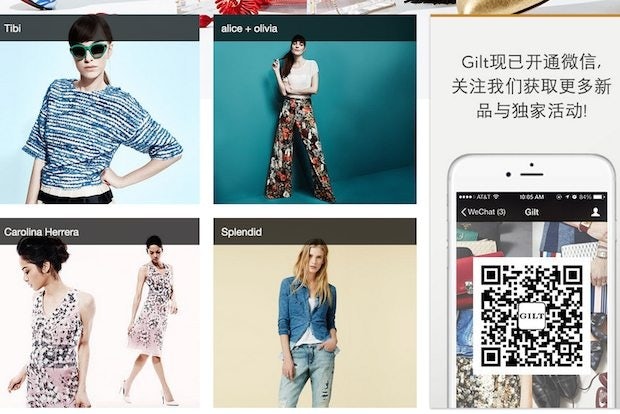

In October last year, Alibaba’s Alipay payment system made major inroads with the internationalization of China’s e-commerce market through its Alipay ePass, which allows consumers to order from a growing number of international sites, among them the Gap, Gilt, and ASOS. Meanwhile, Bloomingdale’s, Macy’s, and Saks Fifth Avenue access these services through Borderfree. In addition, Alibaba has invested in e-commerce platform ShopRunner, which helps the likes of Cole Haan and Neiman Marcus ship to China.

For its part, the Chinese government has been cautiously encouraging these cross-border sales by setting up “bonded warehouse zones” for orders in Shanghai, Zhengzhou, Ningbo, Hangzhou, Chongqing, and Guangzhou—with demand for more warehouse space skyrocketing as orders pour in.

The benefits for Chinese consumers ordering from these online sites are qualitative and quantitative—not only does it open them up to more selection, but they can receive lower tax rates on items than if they were buying them on the mainland.

In addition, these legitimate sales options can provide a reliable alternative to China’s “gray market,” which is composed of individual daigou sellers offering goods smuggled into China or sold from abroad to avoid China’s high tariffs. Although daigou sales can offer significantly cheaper goods, the market is illegal and unregulated, making it a hotbed for fakes being sold as the real thing.

For luxury e-tailers worldwide, these developments mean it's time to pay close attention to logistics—which have been cited as a major headache for those trying to break into China’s e-commerce market for years. When it comes to high-end goods, this goes beyond the basics of just making sure an item gets to a buyer, and returns processed, in a timely fashion. Some luxury e-tailers, such as ShangPin, send couriers who wait for shoppers to try on clothing and even assist with dry cleaning for VIP buyers in lower-tier cities.

Equally important is the fact that brands need to develop an international outlook when it comes to their Chinese e-commerce strategies by recognizing that they’re increasingly competing online not only with daigou sellers, but with legitimate platforms abroad that are offering quality service and lower price points. In order to win the attention of China’s online shoppers, they’ll need to be strategic with their service, selection, and pricing to keep up with a market that’s getting more globalized by the minute.