As Luxury Crackdown Hits Some Brands, Others Find Silver Lining#

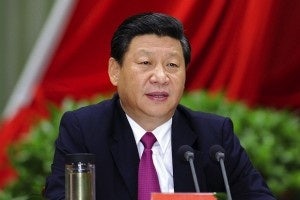

Xi Jinping is pursuing heavy measures to crack down on luxury consumption by officials.

“Cadres must look into a mirror, neaten their dress, take a bath and have the illnesses treated…” – President Xi Jinping

Among watchers of global luxury industries, few issues are more hotly debated today than China’s ongoing crackdown on corruption and the corresponding effects on purveyors of luxury goods.

The current campaign is the latest iteration of a long-running effort to combat “the illnesses – formalism, bureaucracy and hedonism” in the ranks of elite Communist Party leadership. Thus, the crackdown is not merely a utilitarian attack on China’s troublesome scourge of corruption itself, but also clearly focuses on the aesthetics of impropriety within the ranks of provincial officials.

As these restrictions evolve, they will spawn periodic waves of public scolding and the requisite apologies. Most longtime China watchers believe that the heyday of hedonism is not likely to return until well into 2014, if not later.

Some cadres were found to "be hankering for fame and gain, faking achievements and behaving irresponsibly," and some were even "abusing power and becoming morally degenerate." Returning to a "mass line" harking back to the Mao Zedong era, said Professor Zhu Lijia of the Chinese Academy of Governance, the campaign is an obvious attempt by the party to deal with a crisis of public trust.

The good news is that China’s elite government and private-sector leaders seem to be treating this crackdown like any other obstacle in China – they find ways to circumvent the danger while guarding their public images.

The Vacheron complication and Hermès scarf may be hidden, but only from the public eye. Cadres are reacting to this Brave New World of anti-luxury messaging from Beijing by discreetly removing their fancy watches before photo-ops with Premier Li Keqiang, for starters.

The current crackdown on corruption is taking its toll on mainland China’s luxury economy, forcing a dramatic drop in notoriously lavish banquets, high-end traditional Chinese spirits baijiu purchases, as well as lavish gifting -- of watches, in particular.

The effects on outbound tourism spending, however, are not so simple to pin down. It is difficult to parse the impact of the anti-corruption campaign among all the other influences on tourism spending, such as seasonality, evolving travel preferences, changes in taste, and new middle class travelers making their first outbound trips.

Here are the important points that we’re seeing:

- Outbound spending is not as affected as spending within China’s borders. Behavior and spending is simply not as closely scrutinized outside China, reducing the chance that officials or their close associates will be called to task for their spending habits.

- Government travel is significantly depressed. One industry insider notes, for example, that the 2013 government travel budget for one major second-tier Chinese city was less than 10 percent of 2012’s budget.

- Purchase decisions by government officials or gifting for government officials are shifting to favor more subtle products. These decisions are being made on a product-by-product basis, and not simply based on the brand. For example, one tourist in Beverly Hills felt that a certain Chanel bag was too “obvious,” instead choosing a Louis Vuitton bag with a subtle imprint – this indicates that LV’s new logo-less line is a smart tactic.

- Despite the slowdown in government travel, personal and business travel is growing strongly. The government recently announced new measures to promote tourism, including promoting the use of annual leave days and giving workers more flexibility on when and where to travel, and declared tourism to be one of the major social and economic sectors on the government’s agenda.

Is There a Silver Lining for the Luxury Sector?#

Our answer: maybe. Here’s how we see things playing out in the near term:

- Expect continued Chinese overseas investment in real estate, art, wine, gems and other high-ticket items with intrinsic value, which are not as obviously self-indulgent to the public eye.

- Expect continued interest in “stealth wealth” and more subtle purchases by consumers in first-tier cities and those with government connections. This trend is driven by the government crackdown, as well as by changing tastes on the part of more sophisticated consumers. In other words, fewer logo-laden products, more subtle styles, but continuing flight to quality.

- Government delegations traveling overseas will remain weak throughout 2013, and likely into 2014.

- Expect a spike in first overseas trips for many new outbound travelers, as a result of rapid urbanization, a rise in disposable incomes, and relaxation of government restrictions on travel.

As brands like L’Oreal and Michael Kors look to the 260 million people who will enter China’s middle class by 2020, outbound travel will also benefit from this new class of consumers looking to indulge their hedonistic shopping fetishes in gateway cities around the world.

Renee Hartmann is co-founder of China Luxury Advisors, a boutique consultancy that helps luxury brands and retailers to develop China-related strategies, ranging from market entry to social media to attracting, converting, and retaining Chinese tourists. Renee has been focused on the China market since 2000, with a specialty in understanding and selling to the emerging Chinese consumer. She has worked as a brand owner, retail operator, consumer researcher, public relations specialist and market entry strategist in China. Follow China Luxury Advisors on Facebook and Twitter.

(Opinions expressed by columnists do not necessarily reflect the views of the Jing Daily editorial team.)