A roundup of luxury news coming out of China this week, from Ferrari's Year of the Dragon 458 Italia to the launch of the Cotai Sands Central and Beijing's ongoing tug-of-war on stiff luxury taxes.

Ferrari Unveils Ferrari 458 Italia Dragon Edition#

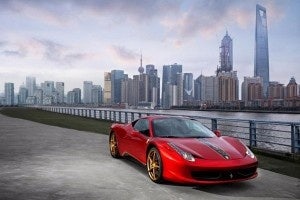

We thought we'd seen the last of the localized "Year of the Dragon" releases, but how wrong we were. Designed to commemorate 2012, both the Year of the Dragon and the automaker's 20th anniversary in the China market, Ferrari this week unveiled its 458 Italia Dragon Edition. Featuring a bright "Marco Polo Red" paint job and festooned with gold and black dragons, Ferrai's China-edition sportscar follows in the footsteps of the Rolls-Royce Dragon Phantom and precedes Aston Martin's soon-to-debut Dragon88, which is set to make its debut at the Beijing Auto Show.

If its flashy red, gold and black exterior wasn't enough to connote extravagance, Ferrari's 458 Italia Dragon also sports gold wheels and enough gold accents in the interior to make Mr. T blush. Additional interior accents include a start button embossed with 20 stars to commemorate the anniversary, and a numbered plaque on the dash. (Reminiscent of the Porsche 10th anniversary China edition 911)

Also as part of its 20th anniversary celebration in China, Ferrai plans to hold its first-ever brand exhibition outside of Italy in "a few weeks," the automaker announced. The exhibition, which will be located at the World Expo Park's Italian Center, is slated to run for at least three years and will feature past and present Ferrari models as well as installations focusing on Design, Ferrari in China and Green Tech.

Sands Cotai Central Opens In Macau#

The newest addition to Macau's Cotai Strip, this week the Las Vegas Sands Corp. opened the doors of its US$4.4 billion Sands Cotai Central casino resort in Macau. As Jing Daily noted last month, the first phase of the launch will include more than 600 rooms and suites under the Conrad hotel brand and more than 1,200 Holiday Inn rooms, as well as plenty of meeting, convention and retail space and dining venues.

With the opening of the Cotai Central, Sands China will have invested more than US$8 billion in the Cotai Strip to date in its attempt to fashion the area into a Las Vegas Strip-style destination for entertainment, tourism and gaming. But Sands chairman Sheldon Adelson's ambitions for the city show no sign of lessening, with Adelson saying he's currently seeking Macau government approval to build a new 3,600-room casino hotel, according to Bloomberg. If Adelson's plans go through, this would increase his total investment in Macau to around $15 billion.

As the Las Vegas Review-Journal notes, the Sands Cotai Central is now the 35th casino to open in Macau. This week, Fitch Ratings pointed out that the property is opening at a time of reduced but still steady growth in the former Portuguese colony, writing, "The growth rate slowed to 27 percent in the first quarter, down from 42 percent in 2011 and 58 percent in 2010, but we do not expect a precipitous decline in visitation or gaming trends this year."

Beijing's Tug-Of-War Continues Over Luxury Tax Reduction#

Since we first covered it 13 months ago around the time of the 2011 National People's Congress (NPC), one of our favorite ongoing stories in the China luxury industry has been Beijing's exhaustively discussed plan to possibly reduce the country's high luxury taxes. These taxes, which can tack an additional 30-40 percent onto the price of imported high-end goods, have long been instrumental in driving Chinese consumers to buy luxury items in Hong Kong, North America or Europe. With calls for the Beijing government to reform the import tax system coming from bureaucrats, businesspeople and shoppers alike, Beijing made cursory moves late last year to reduce taxes on 730 consumer products, including high-end cosmetics, cigarettes and liquor. However, as Jing Daily pointed out last month, these moves have had little effect, as price increases of anywhere from 5-15 percent by the brands themselves have outpaced tax reductions (which averaged a weak 4.4 percent).

As we pointed out last October, one reason regularly hinted at for Beijing's slow moves in reforming the luxury tax code is infighting between the Ministry of Commerce and Ministry of Finance. While the Ministry of Commerce strongly supports tariff cuts to spur more Chinese consumers to shop domestically, China Daily wrote last year that the Ministry of Finance opposes the cuts. And in typically opaque fashion, Shen Danyang, a spokesman for the Ministry of Commerce, said in October that “it’s unclear whether the two ministries have reached a consensus.”

So, in the month since Liu Kegu, a former official on fiscal and tax reform at the Ministry of Finance, said Chinese government ministries “must get ready for the [luxury tax reduction],” has there been any real progress? This week, the Wall Street Journal takes a look:

One possible compromise is the creation of special luxury zones— urban centers where the normal high taxes are lowered. If that plan gets off the drawing board, the big loser would be Hong Kong, where mainland shoppers arrive in droves to take advantage of zero luxury taxes. Around 28.1 million arrivals from China made up more than two-thirds of the visitors last year.

...

[T]he creation of luxury zones on the mainland would bring luxury goods closer to home for parts of China's rising middle class that don't want the hassle and expense of a trip to Hong Kong. More importantly, lowering the taxes gives the luxury houses an enviable choice for ratcheting up the profitability of their mainland businesses. They can lower prices and generate more volume or keep prices high and reap higher margins. Either way, they win.

While "luxury zones" in the Chinese Mainland could be a boon for the domestic retail industry and luxury brands alike, the WSJ notes, they do have the potential to make Hong Kong lose out on one of its most consistent and lucrative groups of shoppers. Still, given the snail's pace with which Beijing has moved on coming to an agreement on what the word "luxury" even means, and to what extent luxury taxes should be lowered, we'd say Hong Kong has little to worry about for the next few years at least.