Welcome to China Film File, a weekly brief on the business of movies in China. In this week’s news: industry-shaking deals, censorship insights, and Robocop on top.

Box office powerhouse Robocop.

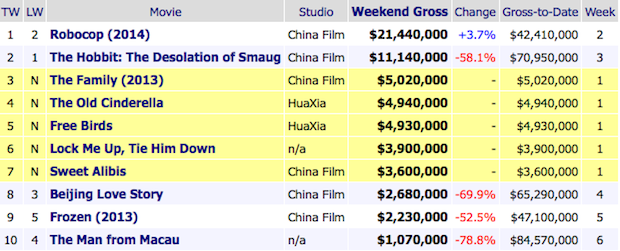

Robocop is continuing a strong run in China with little competition for the top slot in the mainland’s box office.#

The imported 3D blockbuster pulled in the lion’s share of the box office, grossing over $21 million last week.

(Box office results courtsey of Box Office Mojo.)#

Chinese firm Hony Capital is serving as anchor investor with financiers TPG Capital to fund Hollywood mogul Robert Simond’s new studio venture.#

Looking to capitalize on China’s growing market along with newly created American scheduling gaps, the group’s goal is to produce traditional mid-budget ($40 million) star vehicles distributed through their own deals with theater chains. The studio hopes to ensure the release of about 10 films every year while also using its Shanghai Media Group (fresh from a partnership with Disney) connections to help develop films intended for Chinese co-production status.

Because of current market strategies that find the biggest Hollywood studios pouring more money into fewer “tentpole” blockbuster productions, the studio hopes to meet the new American demand for film releases outside of major studio windows like Christmas and the summer. Another way the group hopes to take advantage of today's industry environment is a plan to bypass other large-scale Hollywood houses' ties to box offices and directly distribute films via deals with theater chains like Regal, Cinemark, and the Wang Jianlin-owned AMC.

Robert Simonds on the left at the U.S. premier of Jackie Chan actioner The Spy Next Door.

Chinese online marketplace Alibaba has bought a 60 percent stake of producer/distributor group ChinaVision Media.#

Looking to use the deal as leverage for more control of China’s internet, the stake will let Alibaba enter China’s television, film, and video markets. ChinaVision routinely produces and distributes high-figure content like China’s enormously popular 3D blockbuster Journey to the West, along with televised international soccer matches. Through the stake in the entertainment giant, Alibaba hopes to explore the marketability of internet distribution of content, along with movie derivatives and copyright sales—markets that have for the most part been left untapped in China, where box office sales are the main source of film revenue.

Alibaba founder Jack Ma.

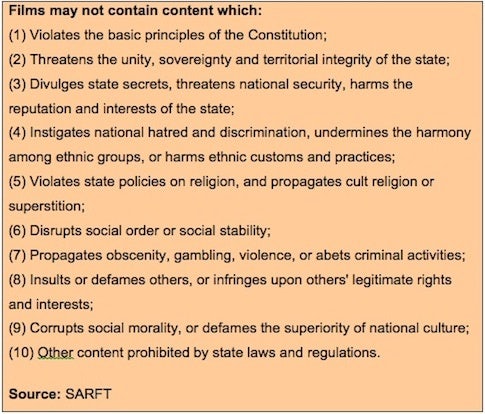

ECNS has routed a couple of insights into the obscure and verboten topics of China’s film censors#

. While the rules are, according to the article, intended to be “hidden,” some of the restrictions that came to light are the censors’ constant struggles to regulate themes involving children born out of wedlock (due to the one- child policy) along with narratives deemed too “superstitious.” Also, in order to “protect minors,” themes with too much young violence or romance are also forbidden.

The ten commandments of China's film censorship courtesy of ChinaFilmBiz.