Luxury shopping in Beijing's Sanlitun area. (Jing Daily)

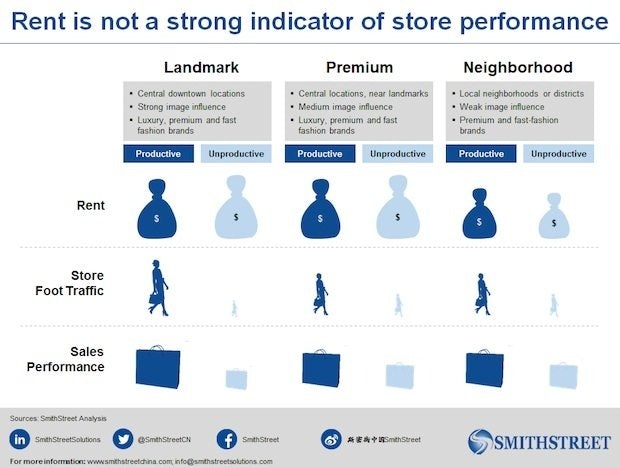

As foreign brands expand their retail presence in China, they typically encounter landlords with more leverage than those in the United States or Europe. This landlord power, however, is not always justified by the reality of locations’ productivity or how they fit into a brand’s overall strategy. To navigate these market inefficiencies and achieve their goals in the China market, it is important for brands to have the full information about the locations they are considering.

China’s landlords are powerful.#

A lack of desirable retail positions means landlords have the luxury of being selective in which brands they allow to enter their malls as well as setting favorable contract terms which maximize their return while minimizing risk. High rent is the norm, the amount often determined monthly by whichever is higher, a fixed rate or percentage of revenue. However, the brand might then find that despite its high investment, contract terms are unregulated and regularly "renegotiated" to the landlord's benefit. Landlords have the right to raise rent, relocate stores within the mall to reflect performance, or even terminate the contract prematurely—tactics which are often used to eliminate the risk of, or force out, an underperforming brand.

Landlord power is not always grounded in#

reality.#

As brands grow in China, there are three types of stores that they should think about, each with their own uses and potential pitfalls:

Landmark Stores: Investments in Growth#

Landmark stores are the "image" stores found in luxury high-fashion malls in top locations, which are used as benchmarks of a brand’s performance by landlords nationally. The rent is high, but for a brand planning significant store roll-out in China, even an unproductive landmark store is a valuable investment in its future growth.

However, brands should consider the usefulness of a landmark location within the context of its own strategy. For a brand planning to enter China with only two or three stores, paying high rent for a store where function is geared toward image rather than productivity is probably unnecessary.

Premium Locations: Beware of Lemons#

Like landmark stores, premium stores are locations in high-end shopping malls, but ones which are not commonly used as a reference point for other landlords. This means that the value of a store can be measured purely by its productivity.

While premium stores include some of the most productive locations in China, along with the high rents to match, not all locations are created equal. Many shopping centers are free-riders on the success of their more productive neighbors, charging equally high rents but without the performance to justify it. Brands should avoid these free-riding locations at all costs.

Neighborhood Stores: Growth Engines?#

Neighborhood stores are premium and fast-fashion malls in less central locations. They generally have the highest foot traffic of the three categories, and although revenues are lower than in premium locations, if the brand chooses well on this criteria then its neighborhood stores will be strong drivers of growth in terms of both presence and profitability.

Timing is a key issue for brands to get right when entering neighborhood locations. Not only should the brand be wary of entering too early and damaging its image, but as ROI on a per-store basis is likely to be lower than in premium locations, investing in neighborhood stores may not be the wisest use of resources in the early stages of a brand’s growth.

Retail expansion should be conducted strategically, not opportunistically.#

It is clear that brands need a greater understanding of the retail environment in order to maximize their success when entering China or evaluating their China presence. A brand that selects malls as the opportunity arises with a landlord, rather than making an informed decision, leaves its success up to chance.

In order to make the right decisions and avoid common real estate mistakes, brands should take a strategic rather than an opportunistic approach to their retail expansion.

By understanding all of the options available to them, brands are able to understand the true value of the locations they are considering, and correctly prioritize which locations will best further their strategy.

The best way to accomplish this is through a bottom-up, on-the-ground approach: identifying all potential malls a brand can be in, mapping the expected productivity for each location, and designing a growth plan and business case based in reality. This ensures that store roll-outs are both implementable and financially successful.

James Button is Director at SmithStreet, a growth consultancy based in Shanghai, where he works with a number of premium and luxury brands on their China entry, growth, and e-commerce strategies. James is also a media contributor focused on retail and fashion in China.

Jules Falzado is Engagement Manager at SmithStreet, where he drives strategies through business analytics and quantitative modeling.