Coach, Michael Kors, Karen Millen See Largely Untapped Market#

As the battle rages on between high-end and high-street brands in mainland China and Hong Kong, one ongoing trend to watch is the success of so-called "accessible luxury" or "affordable luxury" brands in the market, those that span the bridge between luxury and masstige. This segment, maligned as it may be by China's ultra-wealthy brand aficionado, is currently buzzing with the likes of

Coach#

,

Reiss#

,

DKNY#

,

Michael Kors#

, H&M's more upscale sister brand

Collection of Style#

(COS) -- which will enter mainland China this fall --

Paul Smith#

(which will open a new Shanghai flagship this December) and

Karen Millen#

(which launched its first China flagship at Beijing's Parkview Green earlier this month).

As Karen Millen company execs remarked at the Beijing grand opening, China's "bridge" segment remains "largely untapped," leaving plenty of room for expansion, particularly in inland areas where middle-class consumer development is perhaps most pronounced. Karen Millen, for one, hopes to open a further 60 locations throughout China over the next five years, starting with a second flagship in Shanghai in spring 2013 as well as a Chinese-language e-commerce site.

Yet the most successful accessible luxury brand in China since its entry to the market in 2003 has arguably been Coach, which -- despite making a significant proportion of its items in China -- has maintained a strong reputation in the country, particularly among "entry-level-luxury" consumers in second- and third-tier cities. Over the course of this year, Coach will have opened around 30 new stores in the Greater China region, with at least half of them in the Mainland, adding to the 80 regional and 65 mainland China locations the brand operated by the end of 2011. Since buying back its retail businesses in Hong Kong, Macau and mainland China in 2008 and 2009, Coach has seen sales climb rapidly, from US$108 million in 2010 to $188 million last year. In 2012, the company is shooting for sales of “at least” $300 million. By 2014, Coach expects China to be its leading market.

This year, despite a far-from-uniform luxury slowdown in China, Coach has continued to steam ahead as competitors have faltered. During the second quarter of 2012, Coach sales at locations that had been open at least one year in China increased by the double-digits, compared to a tepid 5.5 percent at comparable stores in North America. Following recent entrants to China’s fast-growing — yet crowded and largely untested — e-commerce market, among them Ferragamo, Zara, J. Crew, and Yoox, Coach is set to extend itself further in China with the launch of its long-discussed e-commerce site in China by the end of the year. Though Coach's pilot Tmall experiment late last year led to more buzz than sales, the company is confident that its first large-scale foray into e-commerce will find a more receptive consumer.

So as brands like Burberry, Louis Vuitton and Hugo Boss struggle in a changing China market in 2012 (stung by a host of factors, of which a "luxury slowdown" is just one), what is it that has made accessible luxury brands so successful? Aside from a more crowd-pleasing price point -- keep in mind that not every middle-class Chinese (average household income roughly US$$10,000-$60,000) wants to save up for months for a Lanvin handbag or Maison Martin Margiela jacket -- "bridge" brands have strongly targeted the increasingly lucrative young consumer. Whereas brands firmly in the luxury segment (e.g., Chanel, Louis Vuitton, Hermes) have quite rightly gone after the broad 30-50-year-old consumer, Coach and Michael Kors have focused more intently on young, 20-30-year-old shoppers, particularly those outside of top-tier cities.

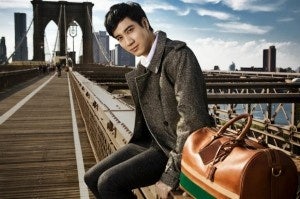

Though these brands also appeal to older Chinese consumers -- middle-aged shoppers are a regular sight at Coach's New York or Hong Kong flagships -- they tend to be an affordable first step into the luxury segment for post-collegiate Chinese just entering the workforce or those a few years into their careers. With the spending power of this young demographic continuing to rise, Coach has looked to appeal to younger shoppers in China and regionally this year by signing popular actor and singer Wang Leehom as the face of its men’s accessories line, and collaborating with Chinese graffiti artist Zhang Lan on a limited edition year of the dragon collection and Weibo campaign.

So, while the Birkin bag might be the dream, for now the Poppy Tote might be an acceptable reality.