China's Appetite For Luxury Goods Expected To Rise 35 Percent This Year To US$17 Billion#

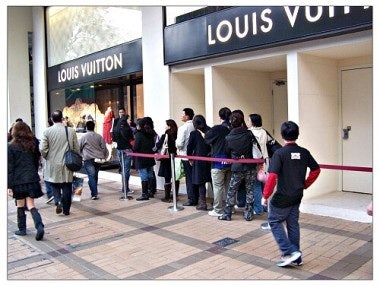

We've become accustomed to seeing droves of mainland Chinese tourist-shoppers crowding boutiques and high-end malls in Hong Kong for quite some time, but this week an article in the National details just how important these hordes of mainland "bling babes" have become to the city's luxury market. With Hong Kong now seen as something of a "Toys 'R' Us for China's nouveau riche," as one bank executive put it, locals are feeling the squeeze, increasingly ignored by staff and greeted in Mandarin rather than Cantonese, jostling for space in stores alongside cash-flush and seemingly insatiable mainlanders. But this means little to brands that are relishing the sight of long lines of Chinese shoppers forming daily in front of flagships in Central and Causeway Bay.

As a Bain & Company report noted in October, China's appetite for luxury brands is expected to rise 35 percent this year to US$17 billion, a figure that's even more impressive when you take into consideration that demand rose some 30 percent in 2010. Lumping Hong Kong, Macau and Taiwan into the Greater China figures, Bain estimates spending in the region will reach US$31.4 billion this year alone. But will the apparently unstoppable growth seen over the past several years in Hong Kong's high-end market continue unabated? From the National:

[China's luxury] buying binge is fuelling double-digit growth in the retail sector, with luxury labels cashing in, despite the threat of a worldwide slowdown sparked by the euro-zone crisis and fears over the global banking industry.

The China syndrome is also rippling through the hotel industry as mainland shopaholics pour into the city armed with Hong Kong dollars.

In a HSBC report earlier this year, the bling babes and their wealthy husbands and boyfriends were dubbed "walking ATMs" as they spend, spend, spend.

"Registers have been ringing non-stop in Hong Kong since the start of this year, a trend that stays firmly in place," says Donna Kwok, a Greater China economist at HSBC.

Continued bullishness about the Hong Kong luxury market, and the resilience of mainland Chinese tourist-shoppers, are among the major factors fueling interest in listing on the Hong Kong stock exchange among some of the world's best-known brands. Earlier this year, Prada and Samsonite listed in Hong Kong, and in the months ahead many expect Western stalwarts like Aston Martin, Burberry, Coach, Ducati and Graff Diamonds to do the same in order to fuel Chinese expansion. As Sam Kendall, head of equity capital markets for Asia-Pacific at UBS, told Bloomberg of this flurry of Hong Kong IPOs, "Companies want to face their future, not their past." If that's the case, these companies certainly are putting a great deal of faith in the China market.

For the moment, with brands crowding in and mainland Chinese tourist-shoppers spending freely, Hong Kong locals can do little but watch as their city becomes one of the world's most hotly contested luxury battlegrounds:

"When you walk into one of the big brands, the sales assistant immediately greets you in Mandarin," says a seasoned Hong Kong shopper. "When you answer in Cantonese, they realise you are local and move on to the next customer. They think you might be just browsing. The mainlanders are here to buy, and buy big.

"In one top name brand shop I saw a group of mainland girls looking at an array of handbags, costing around HK$10,000 [Dh4,725] to HK$15,000 each," she adds. "Pointing to two of the bags, they called over the sales assistant, and said, 'We'll take them all apart from those two.' They paid in cash."