When it comes to Chinese luxury spending, the boom, apparently, has only just begun.

Executives of Chinese technology giant Tencent Holdings, in New York City for the marketing industry’s annual “Advertising Week” events, released the striking results of a report done with Boston Consulting Group on the digital behaviors of Chinese luxury consumers. It predicts China’s personal luxury goods market (including overseas purchases) will grow by 6 percent annually, from now through 2024, to become a 187 billion market. Chinese luxury consumers will account for 40 percent of the global buyers (in numbers) by 2024, driving 70 percent (in dollars) of the growth.

The study, based on surveys of 2,620 Chinese consumers who purchased luxury products over the past 12 months, revealed three surprising customer-behavior trends:

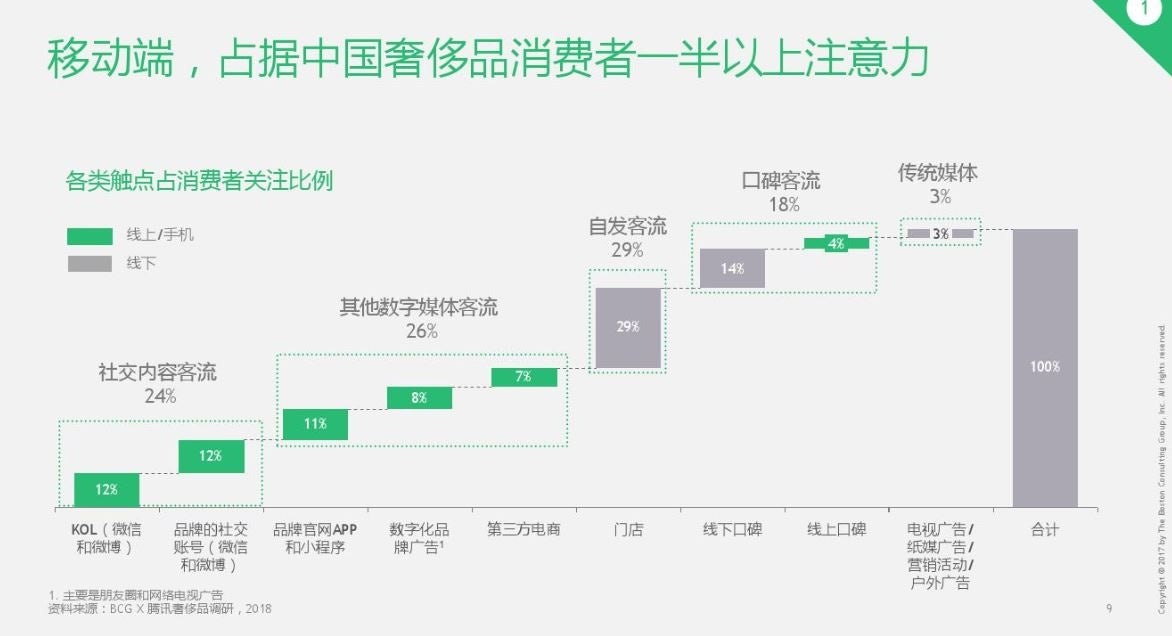

A mobile-first, yet highly fragmented, digital path#

The study finds the starting point of the luxury purchasing journey for more than 50 percent of survey respondents is reading or researching on mobile. That makes sense, but the surprise is that, (unlike in the U.S., with Amazon.com) it is still a free-for-all for brands, with no winner in sight as the single dominant shopping or informational channel emerging.

Chinese consumers discover luxury brands and items through a variety of highly fragmented online channels, including WeChat (brands and key opinion leaders' (KOLs) official accounts, so-called “moments ads,” and mini-programs), Weibo, e-commerce sites (Tmall, Tencent’s own JD.com, and the fashion house sites), as well as digital fashion magazines and video sites.

To break it down, 12 percent of shoppers read about luxury brands on KOLs’ Weibo and WeChat accounts, and 12 percent of them do that on brand’s social media platforms. Eleven percent of consumers receive luxury information from brand’s official websites, apps and mini-programs, followed by eight percent of them via brands’ digital ads and seven percent from third-party e-commerce parties.

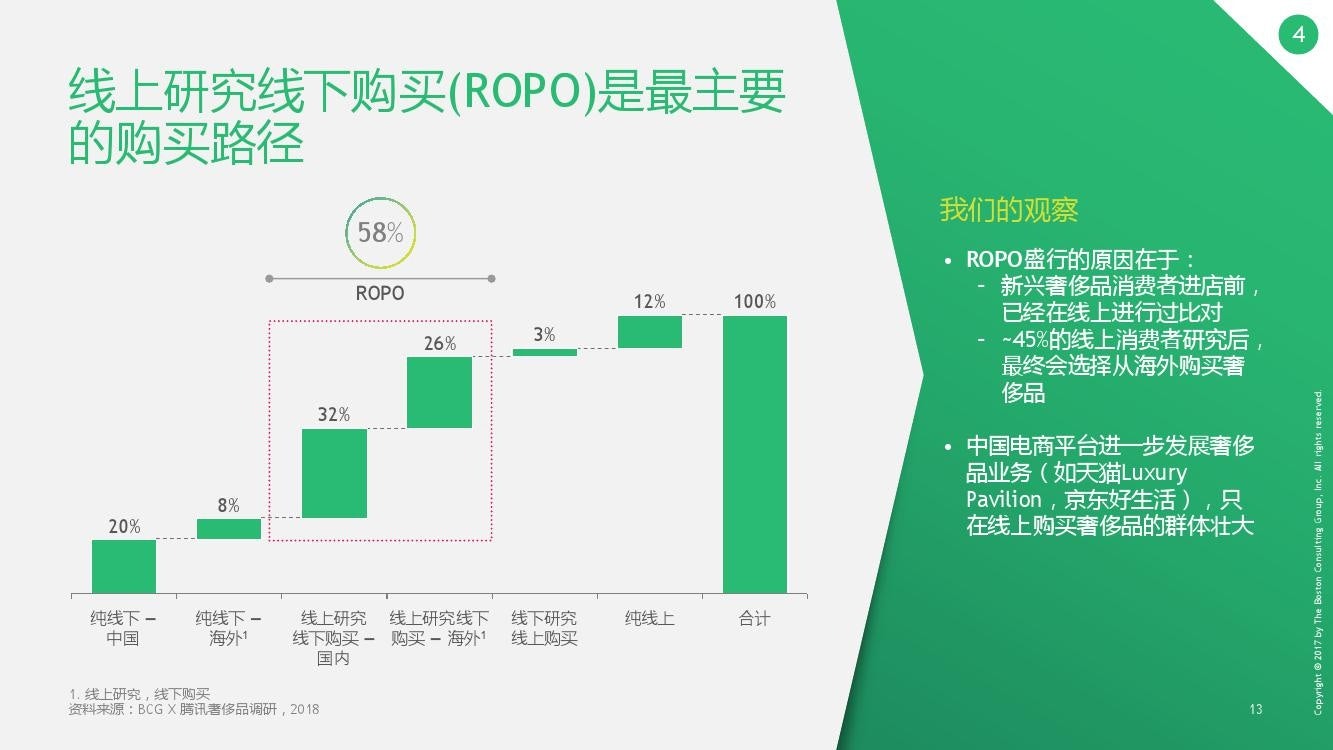

“Research online, purchase offline” retail behavior#

For all the buzz about online splurging, there is no doubt about the importance of omnichannel retail for the luxury industry today: Live shopping still rules. In 2017, 95 percent of luxury purchases happened offline while only five percent occurred online, according to the report. In particular, “research online, purchase offline” is the main path that Chinese luxury shoppers (58 percent of respondents) like to take at the moment, the report notes. The reverse path, that is "research offline, purchase online," happens only when luxury brands organize offline exhibitions.

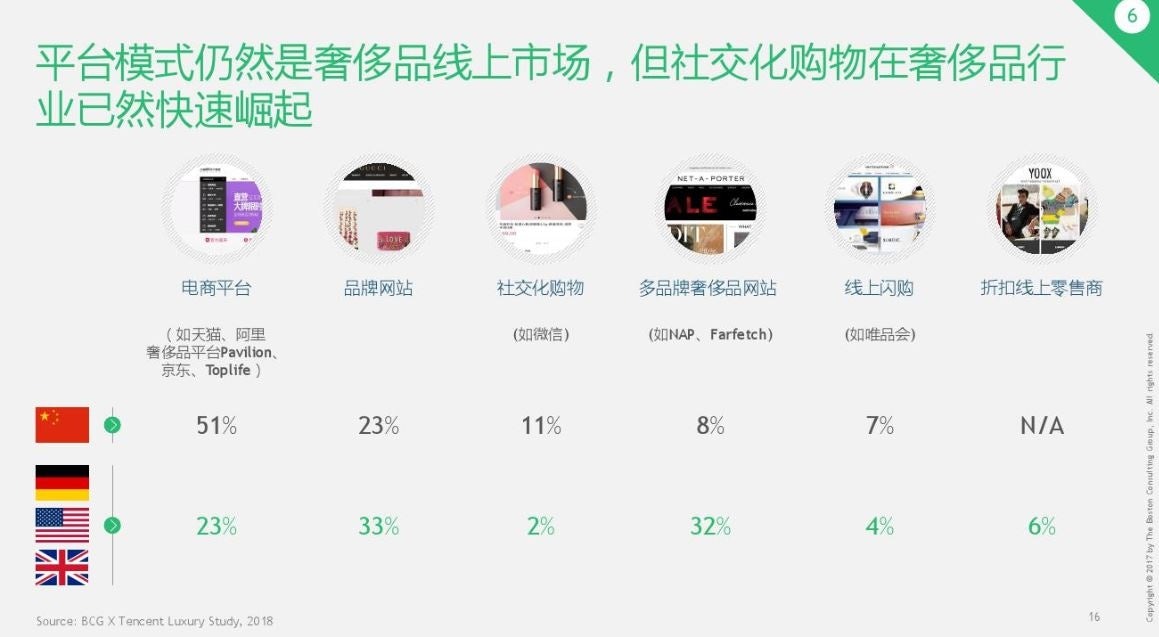

Shopping on WeChat, social media, on the rise#

The report shows more than half of online luxury transactions happen on major e-commerce websites such as Alibaba’s Tmall, Luxury Pavilion, and JD.com’s TopLife, and nearly a quarter of them takes place on brand’s official e-commerce sites. Nevertheless, the report says social commerce, which is led by platforms such as WeChat and Little Red Book, is rapidly catching up. The social commerce shopping mode currently accounts for 11 percent of online luxury sales volume in China.

Of course, much of the research was done before heightened trade tensions with the U.S., and some analysts also see signs of a softening economy in China, so it remains to be seen if the very rosy retail outlook for luxury shopping by Chinese buyers holds true.