Demand From New Chinese Collectors Sees Revenue Skyrocket Among Chinese Auction Houses#

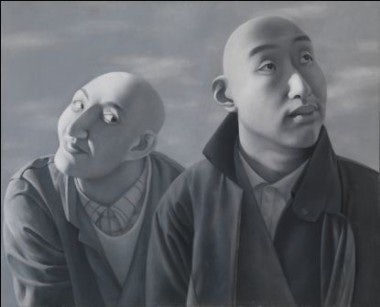

This work by Fang Lijun will likely garner a great deal of attention from Chinese collectors at the upcoming Christie's spring auctions in Hong Kong

With momentum in the Chinese auction market continuing to build, following a string of successful sales in Beijing as well as Hong Kong (which is preparing for the upcoming Christie's spring auctions), international auction houses are considering novel approaches at reaching Chinese collectors while cash-flush and confident Chinese auction houses have their sights set on places a little further from home. Last year, as the Chinese art market sprang back to life, we saw revenue at homegrown Chinese auction houses like China Guardian and Beijing Poly leap ahead, catapulting even higher among global standings. Over the past two years, Guardian and Poly came seemingly out of nowhere to become true potential rivals to globally dominant leaders like Sotheby's and Christie's, with total value of China Guardian and Poly Auction sales skyrocketing from US$284 million in spring 2008 to $1.21 billion last autumn—a rise of nearly 500 percent.

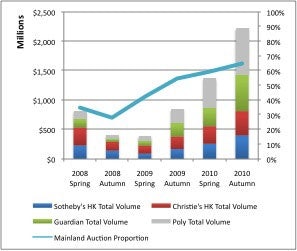

The ability of these auction houses to procure better quality artwork, particularly in the contemporary segment, and directly reach mainland Chinese collectors (Sotheby's and Christie's are limited to operating out of Hong Kong) have been instrumental in this massive growth, which is causing a sea change in the Chinese art market. Whereas China Guardian and Poly made up only 41 percent of market share in the Chinese contemporary art segment in autumn 2009, that number leaped to 56 percent only one year later, reflecting the speed at which the two Chinese auction heavyweights have shot past competitors. Last year, three Chinese auction houses appeared on the world's top five list, after Christie's and Sotheby's (each of which accounted for 26 percent global market share), with #3 Poly grossing US$677 million, #4 China Guardian pulling in $498 million, and #5 Beijing Art Auction selling $256 million worth of art and antiques.

Considering their rapid rise, it's perhaps no surprise that Chinese auction houses are looking to expand in overseas markets. According to Forbes, in a recent interview, Poly International Auction managing director Li Da said her company is thinking of opening an outpost in New York in order to increase its customer base. From the article:

Overseas expansion by Chinese auction companies is part of wider globalization of Chinese art today, according to Kai-Yin Lo of Hong Kong, a visiting professor in the arts and design academy at China’s Tsinghua University and a member of numerous international art and design organizations.

Chinese buyers are looking to buy back historic art and other collectibles originally from the country that are currently held by Western owners, she says. At the same time, Western investors are looking to increase their holdings of contemporary and modern Chinese art, expanding the market for newer works.

Chinese auction houses now account for far more market share in the Chinese contemporary art market (Image: ArtTactic)

The idea of overseas expansion among Chinese auction houses brings up interesting questions, particularly in the contemporary Chinese art segment. As Jing Daily pointed out in our analysis of a recent ArtTactic survey, observers note that the Chinese contemporary art market is currently developing on divergent paths, driven by the disparate buying habits of Chinese and non-Chinese collectors. As we wrote, "the Chinese contemporary art market currently consists of two parallel, and occasionally overlapping, markets: one catering to domestic demand and the other catering to a predominantly international art market. In terms of growth, the domestic market is having the upper hand." While Western collectors, buying through Sotheby's or Christie's for example, still favor Chinese artists like Zhang Huan, Cai Guo-Qiang and Xu Bing, domestic Chinese auction houses often push their own "favored artists," like Guo Reunwen, Yang Feiyun and Shi Chong. Would Poly try to push these same artists in New York? Or will they play it safe and stick to "overlap" artists -- those popular among Western as well as Chinese collectors -- such as Liu Ye, Yue Minjun, Zhang Xiaogang and Liu Xiaodong?

As Poly looks west, Sotheby's and Christie's continue to look east for growth. Later this month, Christie's brand licensee Forever will kick off its 20th Century and Contemporary Chinese Art Sale at the Park Hyatt Beijing, a sale that includes eight pieces of contemporary Chinese art from the collection of Guy Ullens. While the eight pieces pale in comparison to the over 100 lots from the Ullens collection that sold for US$54.9 million last month in Hong Kong, Forever's auction at least indicates two things: one, though barred from directly operating in mainland China, Sotheby's and Christie's are looking for any way to gain a foothold in the China market; and two, mainland China-based auction houses continue to procure better artwork from more established collections and higher-profile artists. We'll have to see what kind of impact a licensee like Forever can really make in the mainland China market, however, particularly when competitors like Poly steam ahead year after year.