Museum-Building Increasing In China To Meet Growing Demand For Art#

Zeng Fanzhi's popularity remains extremely high among collectors (Image: ArtTactic)

Commissioned by this year's Hong Kong International Art Fair (ART HK 11), which Jing Daily profiled on Monday, ArtTactic's latest study on the Chinese contemporary art market is essential reading for anyone who wants to be not only informed about the artists, dealers, and auction houses that are currently redefining the Chinese art market but also the macro-level trends that make the Chinese contemporary art market one of the most dynamic in the world right now. Looking beyond the headlines and bombast, ArtTactic's new study -- available in English and Chinese at the ART HK VIP lounge or online -- turns an objective eye to overall trends, analyzes recent auctions, tracks art market confidence, profiles China's key blue-chip artists, sets out art market models, and (perhaps most importantly to Chinese collectors) includes a list of collector tips.

After a note by ArtTactic founder and managing director, Anders Petterson, the report kicks off with a brief introduction to the Chinese contemporary art world, including a detailed timeline that tracks its inception and development in the late 1970s, through the 1980s and '90s and into its first boom in the mid-2000s. Next, the report looks specifically at the second boom of Chinese contemporary art in 2010. "Whilst most global art markets were experiencing a significant value correction and a dramatic decrease in auction volumes in 2009," the report notes, "the Chinese art market was not affected, in fact, Christie's and Sotheby's Hong Kong sales in 2009 drummed up the second highest total ever, and set the scene for a dramatic boom in 2010."

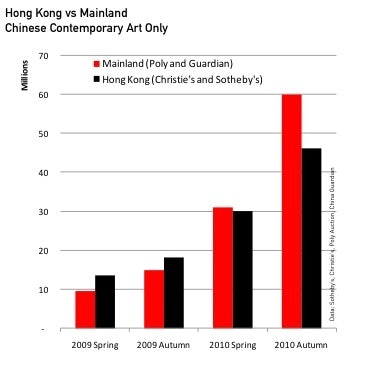

Tracing the dramatic growth seen by domestic Chinese auction houses last year vis-à-vis Sotheby's and Christie's Hong Kong, the report tempers its optimism by pointing out that the risk of speculation in the mainland China market "is a threat that cannot be ignored" and that non-payment in the auction market is "of great concern."

Yang Fudong tops the artist confidence chart (Image: ArtTactic)

Looking next to the increasingly competitive art fair landscape, which has pitted Singapore, Hong Kong and Shanghai against each other in a fight for supremacy, ArtTactic's report points out that 250 galleries are taking part in ART HK 2011, up from 155 last year, a figure that places the fair among the top five worldwide. What does this mean for the Chinese art market? For ART HK, it indicates that a healthy primary art market is developing in the region. As the fair has "established itself as the main international gateway to the Chinese and Asian primary market, as well as an important conduit for Chinese buyers to engage in non-Asian contemporary art," ArtTactic expects ART HK -- now 60 percent owned by Art Basel -- to become the most important contemporary art fair in Asia.

Turning to China's major museum-building push and its increasing ranks of new Chinese collectors, ArtTactic points out that China had 3,020 museums as of 2009, with 100 new museums added every year, and the country now boasts 328 private museums. Listing some of China's most important museums, along with some of the world's most important Chinese contemporary art collectors, the report then explains how Chinese and Indonesian collectors have recently emerged as some of the most important supporters of Chinese contemporary art. This is a sea-change from the market of only a decade ago, when Western super-collectors were some of the most enthusiastic buyers of this art segment. "Whilst the first cycle (1990-2005) of the Chinese contemporary art market was largely driven by demand and interest from Western collectors, such as Uli Sigg and Guy Ullens," the report notes, "the boom market between 2005-2008 was largely driven by Asian demand."

Chinese contemporary art has come back strong from the downturn in 2008 (Image: ArtTactic)

Interestingly, "since the downturn in 2008," ArtTactic notes, "Taiwanese collectors have emerged as one of the most powerful collector groups in the Chinese contemporary art market." 71 percent of respondents told ArtTactic that they believe Taiwanese collectors have the largest impact on the Chinese contemporary art market at the moment. However, mainland Chinese collectors rank in the top five, ahead of US and Indonesian collectors.

This debunks recent perceptions that Chinese collectors were only interested in traditional art and validates observations by Jing Daily and others who have kept a close eye on the trend of growing interest in contemporary art among mainland Chinese buyers.

After pointing out that China overtook the UK last year for the first time to become the world's second largest art market after the US, ArtTactic charts last year's dramatic 271 percent rise in the domestic Chinese art market, which outstripped Christie's and Sotheby's Hong Kong sales for the first time ever by a margin of 19 percent. Incisively noting the differing tastes seen among buyers in the Hong Kong and mainland China markets (a critical observation), ArtTactic writes that contemporary themes and conceptual practices accounted for 64 percent of Hong Kong lots last year. In mainland China, by comparison, 57 percent of lots were more traditional in style.

Reiterating its previous finding that the Chinese contemporary art market is now the most confident in the world, ArtTactic then moves on to an important factor at play in the market -- risk. Asking whether the current Chinese contemporary art boom is an asset bubble or marks a "major shift in consumption of art as a luxury good," the report concludes that the former is likely the case. Findings demonstrate that there are serious differences between the international Chinese contemporary art market and the mainland Chinese contemporary market. This backs up ArtTactic's contention that the Chinese contemporary art market is on a two-track journey driven by "different market dynamics and different types of buyers." What does this mean, exactly? It means that risk in the mainland China market -- where domestic auction houses often champion artists not preferred by the international market, and hot money is more of an issue -- is 49 percent higher than in the international market (which, at 4.1, is 16 percent lower than in September 2010). This, ArtTactic feels, is indicative that a speculative bubble may be forming in the mainland China market.

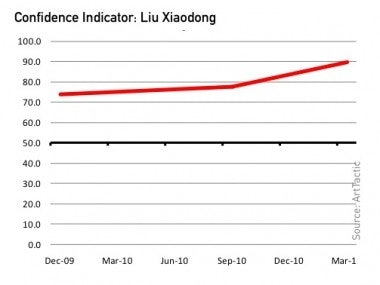

Liu Xiaodong's rising confidence indicator (Image: ArtTactic)

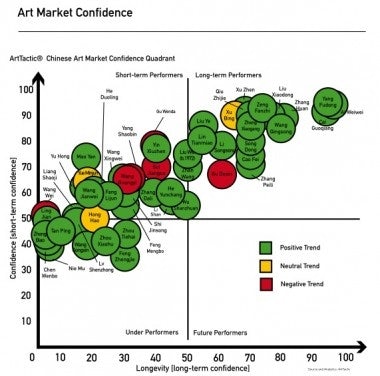

Looking at art market confidence for some of China's top artists, ArtTactic finds positive momentum for several blue-chip artists -- some of whom are popular in the mainland China as well as international markets. These include Yang Fudong, Cai Guo-qiang and Liu Ye. Other artists whom ArtTactic feels have long-term staying power include Wang Qingsong, Ai Weiwei, Cao Fei and Lin Tianmiao.

Over the next several pages, ArtTactic's report offers exhaustively researched, highly detailed profiles of some of the most important artists who have shaped, and continue to shape, the Chinese contemporary art market. Wrapping up with a succinct explanation of the current two-track development of the Chinese market, ArtTactic includes some tips for aspiring collectors about how best to tap the potential of the Chinese contemporary art world while minimizing exposure to risk.

As ArtTactic notes, understanding the market, finding the right art, protecting your investment and enhancing your investment are not only important steps for all collectors to take, they're critical in a fast-growing, dynamic and (perhaps most importantly) complex segment like Chinese contemporary art.

The international and mainland China art markets are very different, but have significant crossover