In just a few years, the explosive development of the e-commerce industry in China has led to the revolutionary transformation of the ways in which luxury brands do business there. Alibaba group has played a crucial role in shaking up the traditional retail sector, but now, the e-commerce giant is bucking the trend by buying up brick-and-mortar stores. With what it calls the “new retail” model, Alibaba is likely to bring big changes to the country’s retail landscape yet again, signalling an opportunity for luxury brands to consider what this can mean for their customer experience.

Last week, Alibaba announced its strategic partnership with Bailian Group, the largest brick-and-mortar retailer by store numbers in China. The deal is the latest move by the company to develop its “new retail” model—a concept first put forward by Jack Ma in 2016. By combining its e-commerce platform with traditional retail physical infrastructure, the new model attempts to create a brand new shopping experience for customers and disrupt the traditional logistics operations of brands by using the latest technologies, such as big data and artificial intelligence.

Over the past year, Alibaba has aggressively acquired sizable Chinese retailers of different types. It has formed partnerships with supermarket retailer Bailian Group, high-end retailer Yintai Group (owner of Intime Department Stores), electronics retailer Suning Commercial Group, and several others.

Alibaba’s “new retail” model could entirely transform the retail landscape in China if it succeeds. Luxury brands could potentially benefit as this new model can provide them an opportunity to offer better omni-channel experiences to consumers. China has seen a wave of store closures by veteran players such as Louis Vuitton and Gucci over the past two years as more luxury retailers now embrace digital channels to sell goods. However, the importance of an in-store experience that distinguishes a luxury brand from its competition is still critical.

A 2016 study by Boston Consulting Group (BCG) revealed that omni-channel retailing is demanded by more than 80 percent of luxury shoppers, and a joint study by ContactLab and Exane BNP Paribas pointed out that brick and mortar department stores on average deliver a better omni-channel retailing experience in comparison with stores featuring a single designer.

Luxury brands today need to become capable of taking care of both the digital and brick and mortar aspects of retail, but the financial constraints and the current social and economic outlook in China can make it difficult to emphasize both adequately.

It's worth noting also that the process of online/offline integration in China is different from the West, where the retailer or brand is the main operator of its e-commerce platforms. But there are certain e-commerce platforms in China that are more forward-looking than others.

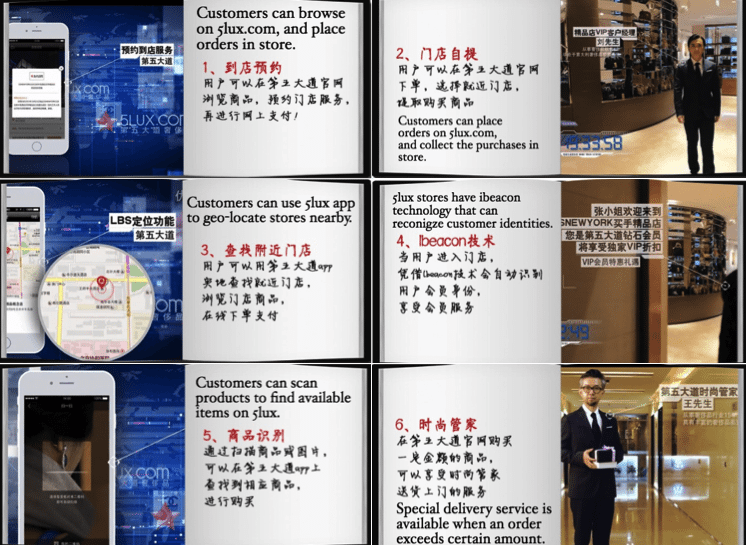

For instance, 5lux.com, a Chinese luxury e-commerce site, has, since 2016, aggressively promoted what it describes as an “online to offline (O2O)” business model. Having business relations with luxury brands including Dior, Gucci, and Bvlgari among others, 5lux.com offers its customers options to order products online and collect their purchases in store, or alternatively, buy products in stores and have them delivered. A 2016 report by the accounting firm PwC noted that the availability of different options is helpful for improving the business-to-customer interaction, which can turn into an opportunity to understand customers' preferences. The transparency provided by this digital platform can also help brands optimize their inventory management.

Alibaba’s ambitions go far beyond the 5lux.com model. “Our partnership is not to strengthen the existing retailing pattern that people are familiar with,” Daniel Zhang, Alibaba’s chief executive officer said at a press conference. “We hope to see chemical reactions. If we can incubate a type of business model that others have never seen, then we are on the right track.”

Luca Solca, the head of luxury goods at Exane BNP Paribas, takes a more cautious stance on Alibaba's latest moves. “I do think it is a must for incumbent retail companies—of which luxury goods brands are a subset—to integrate legacy assets with digital developments,” he said. “Having said that, I find that digital champions moving the other way is peculiar—especially if this involved material capital expenditure investments, as it would dilute return on invested capital (ROIC).”