What This Emerging Sector Means For Your Brand#

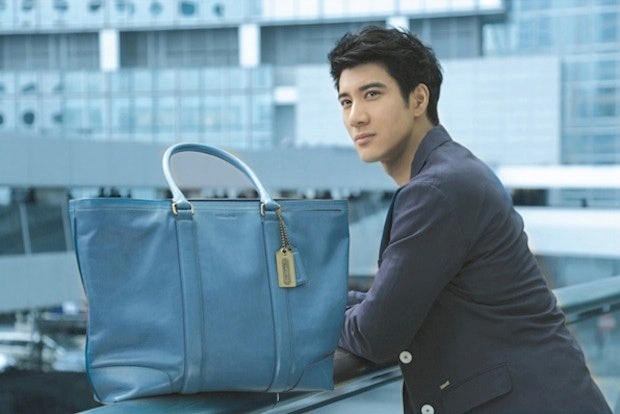

Taiwanese actor Wang Lee-Hom appears in a Chinese ad for Coach, an American brand known for tapping into accessible luxury demand. (Visit Beijing)

A few years ago, the concept of “accessible luxury” as a market mover in China was little more than a dot on the horizon. Today, the situation couldn’t be more different. Accessible luxury brands (and traditional luxury brands that have expanded into the accessible luxury sector) have seen significant growth marked by rapid and profitable retail expansion, increased e-commerce sales, a loyal following of new middle-class customers, and renewed interest and sales from older, wealthier “legacy” customers.

Historically, the luxury segment in China has been dominated by established European labels selling premium and ultra-luxury products to well-heeled Chinese consumers. But with urban professional income in tier-one and tier-two cities like Shanghai and Suzhou ranging from $15,000 to $100,000 per year, and urban per-capita income around $4,000-$6,000 per year, a large new group of middle class consumers--some 300 million of them--have emerged to seek luxury and accessible luxury products.

The rise of the accessible or “affordable” luxury sector is coinciding with, and in part fueled by, an increasing interest in American brands such as Coach, Michael Kors, and Kate Spade, which are expanding on the mainland. American brands in other lifestyle categories are succeeding as well, and are helping blaze the trail for the apparel, footwear, and accessory sectors. And accessible luxury growth is by no means limited to U.S. brands--H&M, Zara, and local favorite Shanghai Tang are succeeding as well.

As I mentioned in my last column, this sector has become a key growth driver for the China luxury market. That said, there is still some confusion on the part of brands and retailers about what defines “accessible luxury” in China, who the key consumers are, what trends are driving growth in the segment, and what strategies are working.

Perhaps we can best understand this sector by thinking of luxury products in China as three distinct categories: ultra-luxury, luxury, and accessible luxury. Of course, these categories apply to luxury markets the world over, but in the face of that emerging, new-to-spending, 300 million-strong middle class, they’re particularly relevant in developing a market strategy in China.

A Tiffany's tie clip.

Some brands sell only in the luxury space, never discounting and never marketing lower-priced or “starter” products. But other global luxury brands offer products in all three categories. For instance, you can buy a $40,000, $80,000 or $160,000 BMW; at Tiffany’s, you can spend $80,000 on a ring, $5,000 on a necklace, or $200 on a tie clip. In many cases, luxury brands develop separate accessible luxury lines, establishing their own brand identities in the global marketplace. Case in point: Emporio Armani, which earlier this year opened a watch and jewelry store in Hong Kong and is poised for a leap to the mainland.

There are a number of trends driving the growth of the accessible luxury sector in China:

“Been There, Done That.”#

There is a sophisticated cohort of wealthy “legacy” luxury consumers who are looking to expand their purchasing options. They’re open to experimenting with new brands, new styles, and expanded offerings from trusted luxury brands -- even lower price points. They want to be leaders and trend setters, not followers, and their discoveries in the accessible luxury sector address this interest.

“Teach Me.”#

A new cohort of middle class luxury consumers is seeking guidance on how to create personal lifestyles for themselves. They’re looking to do this through a mix of accessible luxury and luxury purchases--a $2,000 handbag, for instance, accessorized with a more modest, accessible luxury scarf or shoes.

The Pioneers#

. Outbound China travel has exploded over the past two years. Chinese travelers are projected to take 150 million outbound trips by 2020, making them the world’s most numerous travelers. These business and pleasure travelers, as well as students studying abroad, are exposed to brands they’ve never seen in China, or that have low profiles there, and when these travelers return they start seeking them out at home. They’ve known Louis Vuitton for years, but abroad they may discover such accessible luxury brands as C-Wonder in New York or Belstaff in London.

Home Sweet Home.#

A transformation from “house” to “home/sanctuary” is fueling sales in luxury audio, furniture, artwork, décor, and upscale hardware. Accessible luxury and luxury brands have an opportunity to seize on this newfound desire for “inside” as well as “outside” luxury. Delorme, the French bedding company, is ahead of the curve in this market, and Bang & Olufsen is making a major new investment and expansion in China. Also of note: Ralph Lauren will be opening “lifestyle” floors, selling home décor, within their stores in major shopping malls like Plaza 66 in Shanghai.

Youth Movement#

. China’s young consumers are style-conscious and lifestyle-conscious. Those who live at home, subsidized by family, can spend upwards of 80 to 100 percent of their income on consumer products. They see accessible luxury goods as signifiers of status, individuality, and lifestyle orientation. If you can sell them a $500 bag now, as family wealth increases you may well sell them a $5,000 bag a few years down the road.

The Red, White, and Blue#

. I foresee a continually growing interest among Chinese consumers in American brands and retailers, American style, and American aspirational living. The classic European, ultra, and luxury labels will continue to grow and prosper, but there is room for more players at the table now.

Looking at which international brands are growing and expanding in China and where the demographics are headed, there is no doubt that accessible luxury is now a key market driver in China. It is in the expansion of Coach, Michael Kors, and a dozen other American companies reporting profits from China, as well as European luxury companies offering new product levels and lifestyle stores, that we see the proof. As they experiment with their own personal brands, images, and styles, Chinese consumers want affordable luxury as well as traditional luxury and ultra-luxury brands and products. Companies that spend the time and resources to understand the opportunity, to establish the right infrastructure – product mix, pricing models and brand positioning – may well find that the accessible luxury sector is a key to success in mainland markets.

Michael Zakkour#

is a principal at the global consulting firm

Tompkins International#

, where he heads the China retail, luxury, and fashion practice. He has more than fifteen years’ experience in international market strategy and implementation, primarily in China and Asia. He has assisted more than 250 multinational and SME companies in their assessment of opportunities in China and their resultant entry and growth strategies and implementation. Email: mzakkour@tompkinsinc.com; Twitter: @michaelzakkour

(Opinions expressed by columnists do not necessarily reflect the views of the Jing Daily editorial team.)