As incomes rise for Chinese consumers, the “good life” is becoming about much more than just being able to afford material objects, according to the results of a new McKinsey survey.

The consulting firm’s newly released report “The Modernization of the Chinese Consumer” finds that confidence in future income growth is shrinking, but those who are seeing rising income are investing more in their health and leisure time with family.

The results of the survey of 10,000 Chinese consumers show that economic turbulence has caused confidence in the statement, “My household income will significantly increase in the next five years” to drop by 2 percent between 2012 and 2015. Nonetheless, 55 percent of Chinese consumers still agree with the statement, and geographic pockets including Xiamen, Chongqing, Kunming, and Nanning are more optimistic than this average.

When asked what they’ll be spending more on if their income increases, Chinese consumers continue to prioritize material goods like clothes, but are “allocating more of their income to lifestyle services and experiences such as spas, travel, and entertainment,” says the report. While food and apparel were the top two product categories they’ll spend more on at 46 percent and 37 percent, respectively, the “service” categories “leisure and entertainment” and “travel” came next on the list at 25 and 23 percent.

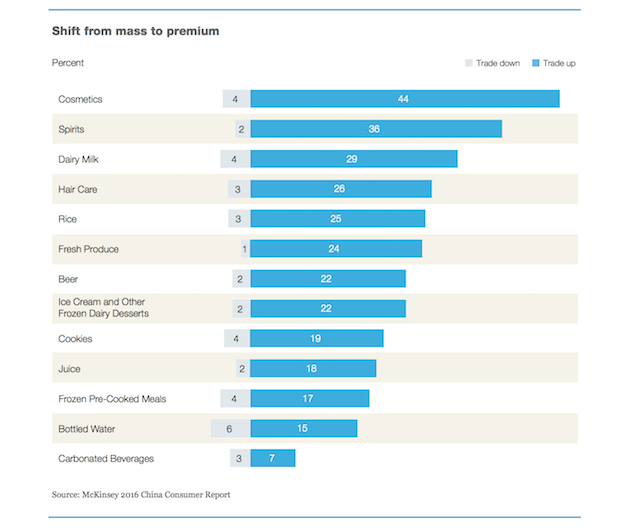

The increased spending on food is tied to a growing focus on healthy living—when asked about their spending on a wide range of household goods and foods, the majority of consumers said they wished to “trade up” to premium brands. This includes categories such as fresh produce, milk, rice, and bottled water, which have all had safety issues in China in recent years. The report says that “organic/green food” was a top criteria for evaluating safety of food, with 38 percent listing it in their top three criteria. The emphasis on safety has particularly benefited foreign food brands.

In addition, the report finds that Chinese consumers are spending much less on less healthy food products such as carbonated soft drinks (down 21 percent) and Western fast food (down 16 percent).

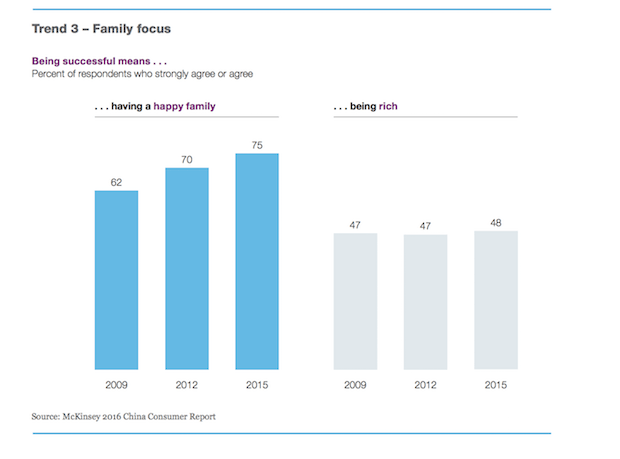

Meanwhile, growing spending on experiences coincides with an increased prioritization of family. The percentage of Chinese consumers who believe “being successful means having a happy family” has risen from 62 percent in 2009 to 75 percent in 2015. Growing travel spending is connected to family time, as 74 percent of of consumers say “travel helps them to better connect with their family,” while the percentage of international trips taken with family has risen to 45 percent from 39 percent in 2012.

But retailers will be happy to learn that spending time with families doesn’t exclude shopping, and the pursuit of status and wealth are still alive and well in the Chinese consumer market. A total of 64 percent of Chinese consumers agree that, “Going shopping with my family is one of the best ways to spend time with them,” up from only 43 percent in 2012. Seventy-nine percent went shopping while traveling in 2015, and 47 percent said that shopping was an important part of their holiday. In addition, the percentage who agree that being successful means “being rich” has also risen by one percentage point to 48 percent from 2012 to 2015.

As a result, the report notes that malls which take advantage of demand for family “retailtainment” with a combination of shopping and lifestyle activities have done especially well recently. “Consumers are moving away from big-box retail outlets such as department stores and hypermarkets," it says, "and are spending more time in shopping malls, which combine shopping, dining, and entertainment experiences that the entire family can enjoy.”