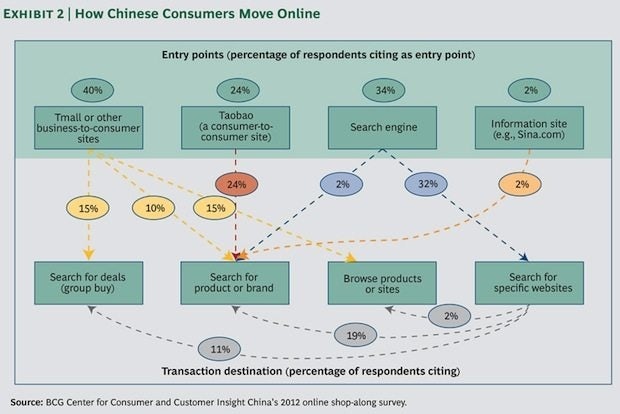

A detailed chart outlining the online activities of China's internet users outlined by the Boston Consulting Group. (Boston Consulting Group)

China’s number of internet users is rapidly expanding as incomes rise: the country is expected to have more than 730 million internet users by 2016, which will include 380 million online shoppers. Since brands hoping to cash in on this growth need to know how and why these consumers are using the web, Boston Consulting Group (BCG) recently published the results of an in-depth study on their habits. Through digital “shop-alongs” and surveys, the group took a look at Chinese consumers' favorite websites and outlets for receiving information about brands—as well as how much time they spent doing it and whether or not they were influenced to buy anything. For more information, below are five key findings from the report about their activities on the web (and what they mean for brands):

Official brand websites: not so important.#

According to the report, Chinese online shoppers in China don't care much about brands’ painstakingly crafted official sites, which take up less than 0.5 percent of their time. Rather, they spend 80 percent of their time online on news, video, and e-commerce sites, and most of the remaining 20 percent on search engines, forums, and mircroblogs.

They stick with their favorites.#

The report finds that Chinese consumers spend 50 to 80 percent of their online time on only a few key websites. Furthermore, five key sites are the favorites for many users: 40 percent of all collective online activities were spent on Youku, Sina, QQ, Taobao, and Baidu. As a result, brands must figure out which sites their target customers are visiting frequently in order to access them.

“Self-education” is key.#

Chinese online shoppers take pains to know extensive details about products before they buy. The report found that 90 percent of product-related online activity is conducted for the purpose of product education and not for an online purchase. When they do buy something, they’re still spending at least an equal amount of time “studying” the brand as they do shopping.

Brands need to fight for their attention on Weibo.#

While the survey respondents follow an average of 18 company-run microblogs, less than 20 percent say that they actually pay attention to the accounts. The type of content companies post can be a factor, however: price- and promotion-related posts gained the most interest, while brand and company news received the least.

Online and offline experiences must be compatible.#

China’s consumers are incredibly tech-savvy, but BCG’s research finds that 40 percent of respondents still believe offline information is equally or more important than online. The firm’s advice is to maintain a “seamless experience” across channels in terms of both information and promotions.